With short-term interest rates at historic lows, and the end of the Federal Reserve’s latest bond purchase program scheduled in October, investors are right to wonder about the prospect of rising interest rates. This wonder naturally turns to concern for fixed income portfolios, which derive their return from the overall level of interest rates in the economy and are thus naturally exposed to the effects of interest rate movements, both positive and negative.

While many take it as a given that rising interest rates are always bad for bond portfolios, the mechanics of bond returns suggest otherwise. The effect of interest rate changes on the returns of a bond (or bond portfolio) depends not only on the direction and magnitude of rate changes but also on the timing of those interest rate changes relative to an investor’s holding period. The reason for this is that higher interest rates, to a bond portfolio, are a double-edged sword – if interest rates rise, current bond holdings will be worth less, but future bond income can be reinvested at higher rates.

Even if we take it as a given that rates will rise (a question that seems certain but that has confounded many forecasters over the years), this fact alone does not tell us that fixed income returns will be negative, or even inferior. The key determinant of returns is the path of rising rates during an investor’s holding period. Roughly speaking, assuming that rates will rise over a given holding period, fixed income investors prefer to see the rates rise sooner rather than later, so as to see a quick drawdown (one side of the sword), but then a longer period of higher coupon payments (from the other). Under this scenario, rising rates can actually increase a bond portfolio’s return. The worst-case scenario for a fixed income investor is to have static low rates until the end of a holding period, and then a dramatic rise at its end. This scenario leaves the investor holding a low-coupon asset for most of the holding period, and then a drawdown at the end of the period as rates rise. Between these two extremes, a period of gradually rising rates will produce a return somewhere closer to the portfolio’s initial yield.

Knowing this tells us that it is not rising rates themselves that long-term bond investors should fear. Instead, investors should fear a dramatic rise in rates, timed at the end of their bond holding period. For longer-term investors, how realistic is that fear? To answer the question, we examined the historical paths of recent Federal Reserve rate hikes, and the effects of those rate hikes on the bond market.

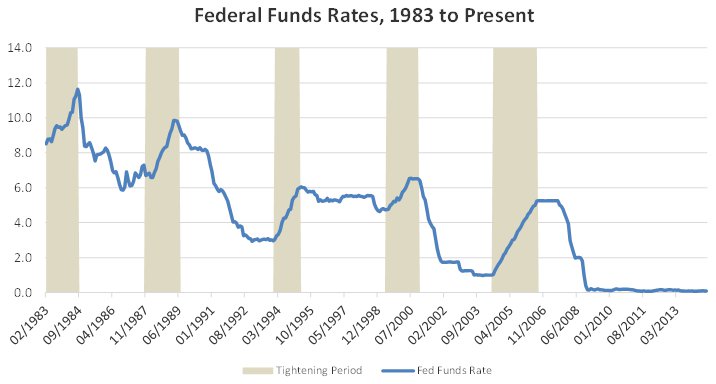

The following chart depicts the benchmark Federal Funds rate in the modern Federal Reserve era (beginning in 1983, the first year of real economic expansion after Paul Volcker famously “broke the back” of high inflation). In the modern Fed era, not including the 1983-84 continuation of prior policies, there have been four periods of Fed tightening.

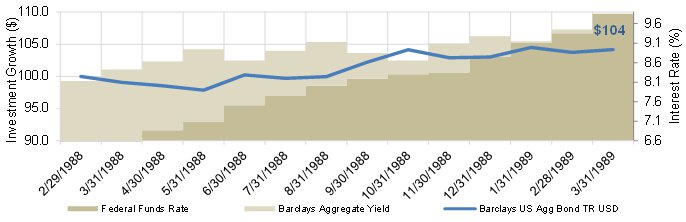

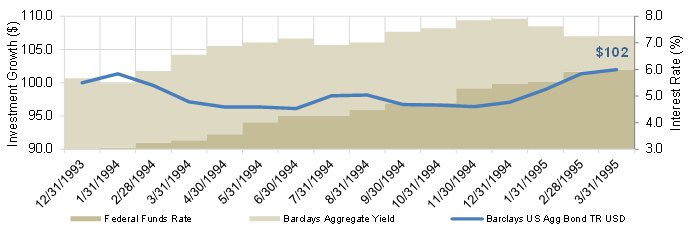

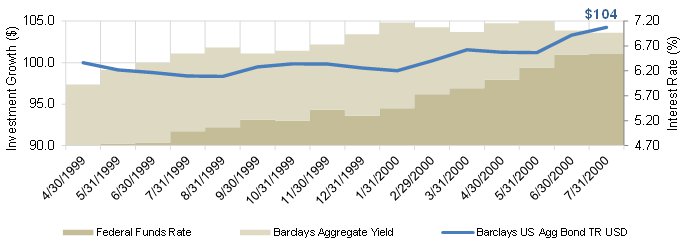

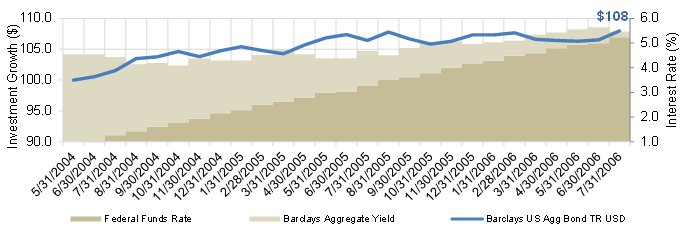

Examining each of these Fed-tightening periods is revealing, and perhaps surprising. They ranged from 13 to 26 months in length, and the Fed’s target rate followed varying paths upward. In every case, however, the Fed raised rates gradually, and the effect on bond portfolios was not devastating. The following charts depict the actual paths of Fed rate hikes in each of these four periods in the darker tan, and the cumulative return to the Barclays Aggregate Bond Index, a proxy for the investment-grade US bond market, in blue. We have also plotted the yield path of the Barclays Aggregate Bond Index in lighter tan.

March 1, 1988 to March 31, 1989

- 13-month tightening period

- Total Fed Funds rate rise: +327 basis points

- Total Barclays Aggregate yield rise: +144 basis points

- Barclays Aggregate Index Return = +4.2%

January 1, 1994 to March 31, 1995

- 15-month tightening period

- Total Fed Funds rate rise: +302 basis points

- Total Barclays Aggregate yield rise: +159 basis points

- Barclays Aggregate Index Return = +2.0%

May 1, 1999 to July 31, 2000

- 15-month tightening period

- Total Fed Funds rate rise: +184 basis points

- Total Barclays Aggregate yield rise: +104 basis points

- Barclays Aggregate Index Return = +4.3%

June 1, 2004 to July 31, 2006

- 26-month tightening period

- Total Fed Funds rate rise: +424 basis points

- Total Barclays Aggregate yield rise: +92 basis points

- Barclays Aggregate Index Return = +8.0%

Far from being sharp and at the end of a holding period, the actual upward path of the Fed’s target interest rate was, in every case, gradual. Moreover, while in every case the Barclays Aggregate Bond Index, a proxy for the typical investor’s bond portfolio, saw its own yield rise in tandem with the Fed’s rate, that rise was always more gradual and muted than the Fed’s rate. As a result, bond returns were acceptable – perhaps not stellar, but certainly nothing to have been feared.

What is striking to us is that there was no case in which the benchmark bond portfolio declined in value during a full period of Fed-induced rising interest rates. Of course, these charts do not depict subsequent periods of higher return for bonds, after rates have risen, because of higher coupon payments and reinvestment rates. Nor do they depict subsequent cyclical declines in interest rates, which produced not only high starting coupon income but a tailwind of capital appreciation. No, these charts show only the bad interest-rate periods for bonds – and those periods weren’t that bad at all.

An important caveat to this historical examination is that interest rates are, in fact, at record lows. In the past periods we have depicted, the going-in coupon rate was high enough, due to higher interest rates, to withstand the capital loss associated with the rising rates. It is very well possible that this time is different, because current coupons are so low in absolute terms. We have no historical data to examine for periods where the Fed began a rate-tightening cycle starting from Federal Funds at 0%, or when the starting yield of the Barclays Aggregate was 2.2% (its present yield).

Finally, we note that there is one type of bond investor who should fear rising rates: the short-term investor. Clients that have near-term needs for the return of their capital cannot afford to take the risk of an increase in rates at any point in their investment horizon, because it is not long enough to recoup a drawdown with higher coupons, reinvested at higher rates. For these clients, we recommend shorter-duration fixed income products that are not as exposed to interest-rate risk as intermediate-term bonds (of the sort found in the Barclays Aggregate Index) are.

We share the market’s consensus that rates will rise at some point, although our experience teaches us not to forecast the timing of the rise. What we do not share is the opinion that rising rates necessarily imply that investors should flee from their fixed income portfolios. As one of the few asset classes with a reliably low correlation to equities, bonds play an essential diversification role in portfolios, regardless of future interest rate changes. Changing the composition of a carefully crafted portfolio to anticipate rate changes not only risks the forecast being wrong, but it risks altering the portfolio’s overall risk profile as well, at a time when bonds are far from the only asset class susceptible to drawdowns based on reversion to long-term valuation means.

Yes, interest rates will rise, at some point. But we believe that this fact alone doesn’t tell a bond investor much. We continue to recommend diversified portfolios that include bonds. They face risks, but what asset class doesn’t?