The job of a defined contribution plan sponsor is not an easy one. Plan fiduciaries are responsible not only for monitoring service providers and an investment lineup, but educating plan participants, monitoring plan costs and investment management fees, and complying with ever-changing regulations. It’s a complex task that requires a wide range of skills, and experience is the best teacher.

Sellwood’s investment professionals have extensive experience advising defined contribution plans of all types, including 401(k), 401(a), 403(b), 457, profit sharing, and 529 college savings and ABLE Act plans. We have expertise in all aspects of plan design and monitoring, including investment policy development, investment menu construction, manager selection, performance reporting, plan fee reviews, participant education, and service provider searches. Our advice is informed by ongoing evaluation of new regulations and industry trends.

We work with defined contribution plan sponsors to understand their specific plan and demographics so that we can help increase employee participation and savings rates, educate participants, and provide the plan with an investment lineup that is easy to understand and allows for diversified portfolios, with low and transparent fees.

![]()

Uncompromising. And Uncompromised.

Sellwood’s ethics are second to none.

Sellwood acts as a fiduciary with respect to all of the services that we provide, to all clients, meaning that we consider client interests first and foremost. Our firm always has been, and always will be, absolutely free from any conflicts of interest. We have no financial relationships with investment managers or service providers that we may recommend to clients. We do not accept revenue sharing, 12-b1 fees, or any other payments that would compromise our objectivity. 100% of our revenues are in the form of cash payments from our clients, meaning 100% of our advice is worth taking. We do not employ placement agents or other outside marketers.

We encourage you to review our responses to the ten questions that the SEC and Department of Labor encourages all plan sponsors to ask their retirement plan consultant.

Our firm adheres to a strict internal Code of Ethics and all employees are bound by the CFA Institute Code of Ethics & Standards of Professional Conduct.

![]()

Broad Institutional Investment Expertise

Unlike many advisory firms that serve defined contribution plans, all of Sellwood’s consulting team members have experience providing investment advice to a range of institutional client types, including defined contribution plans, endowments/foundations, pension plans and other institutional client types. This broad perspective allows us to leverage investment concepts and ideas utilized by other plan types to improve defined contribution plan investment lineups.

![]()

Customized Investment Plan Lineups

We approach each client individually, and we understand that no portfolio will be appropriate for all clients. Before recommending a single investment be added to a plan lineup, we first seek to understand the client’s circumstances and the Plan’s demographics in all their complexity. It is only with this understanding that we can recommend investments that appropriately balance returns and risks and set up participants for investment success. Every plan lineup that we recommend is customized to the individual client; we have no templates.

![]()

Comprehensive Participant Education

We believe strongly in the value of participant education, and that informed participants make the best decisions about investing their retirement savings. For defined contribution plans, we take leadership of structuring a comprehensive educational offering, incorporating resources from Sellwood, the plan’s recordkeeper, and the client. We develop customized materials for each client we work with, and present group and individual education sessions for participants.

At the same time, Sellwood does not advise 401(k) plan participants as clients themselves, so we do not possess a common conflict of interest, whereby the advisor has financial incentives to roll participant assets out of the plan, or provide different levels of service to participants with different balances. We serve only the plan, do not cross-sell any services to participants, and we are fiduciaries in writing for the education that we provide to participants, removing several important sources of fiduciary risk to plan sponsors.

![]()

Performance Reporting Designed Specifically for DC Plans

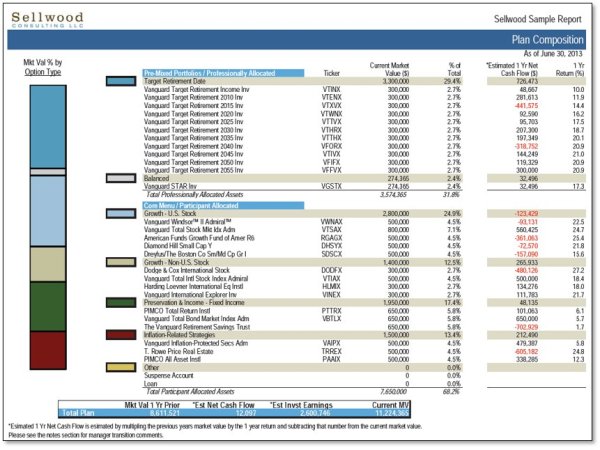

For a defined contribution plan sponsor, the plan elements that need to be monitored go far beyond just the return of individual investment options. Our reporting is designed specifically to allow plan sponsors to monitor each investment element required of an ERISA plan sponsor (whether or not the plan is subject to ERISA, we believe that its fiduciary requirements represent best practice). In addition to net-of-fees reporting of all investments versus appropriate benchmarks and institutional peer groups, our reporting:

- Organizes plan options by tier and type, to allow for better understanding of each investment’s role in the plan lineup and usage by participants.

- Presents estimated plan-level cash flows for each investment option, over the past year. Cash flows can sometimes indicate the need for participant education.

- Summarizes all fees paid by the sponsor and from the plan, including the investment fund offerings and all service providers, currently and over time.

- Provides a full accounting for all revenue share that may be present in the plan. Accounting for all revenue share allows plan sponsors to fulfill their fiduciary duty of ensuring that only reasonable fees are being paid by participants.

![]()

Customized Discretionary (OCIO) Services

Some clients want only our advice, and others want us to both provide and implement our advice. We are comfortable under either approach, or anywhere in between. For ERISA clients, we offer fiduciary advice under ERISA §3(21) or §3(38). Either way, we are a fiduciary for 100% of the services that we provide. We believe that like investment advice, implementation discretion works best when it is customized to the client’s unique needs. We believe that discretion to implement investment decisions is not a binary “on or off” condition but instead exists along a spectrum, and we encourage our clients to consider which level of implementation services fits them best.

![]()

Experienced & Stable

We believe that stability of an investment advisory team is the most often overlooked factor in long-term investment success. There are rewards to long-term investment thinking, but those rewards can only be realized with a stable advisory firm and team. The best investment advice is provided by an experienced consultant, in the context of a long-term relationship between the client and that person. For these reasons, we have designed our firm and consulting team to be among the most stable in the industry.

Each of our client-facing consultants has at least 18 years of institutional investment advisory experience. We are 100% owned by our current employees, and our firm’s ownership is distributed broadly within the firm. Our investment advisory team has experienced 0% turnover since our firm’s inception. Our ownership culture and governance mechanisms ensure that Sellwood will remain a viable partner to the clients we serve for years to come.

![]()

The Sellwood Difference

Good advice arises from thoughtful structure. Our absolute freedom from conflicts of interest means that we sit on the same side of the table as our clients, and that our recommendations or decisions are always designed to benefit the portfolio. We bring large-firm experience and expertise, while retaining the client service focus of a boutique. Each of our consultants has at least 18 years of experience advising institutional clients, and continuity of our consulting team is a critical core value at Sellwood, meaning we offer clients unmatched stability in their consultant relationships. And our advice to clients is advice worth taking: we hold ourselves to the fiduciary standard of care for 100% of the services we provide to 100% of our clients.

We would be delighted to discuss Sellwood Consulting’s defined contribution plan capabilities with you directly. Please contact us to arrange an introductory meeting or call.