Investing nonprofit portfolios, including endowments, foundations, and long- and short-term reserves, is a core Sellwood service offering and area of expertise. We begin our customized process with a review of your organization and current investment portfolios. We work with you to understand your organization, mission, objectives, and constraints so that we can build a portfolio that meets your goals within defined investment policies and guidelines.

![]()

Research Focus

Sellwood’s research process is deliberate, thoughtful, and consistent, as are our recommendations to clients.

We believe it is essential to operate under a defined Investment Philosophy, which has always guided our firm’s recommendations to clients. We believe that our primary function is the creation of portfolios that are customized for our clients’ unique return and risk requirements.

All of our client recommendations are considered and vetted by our Investment Committee, which meets weekly and is comprised of all of our firm’s senior, client-facing professionals. This deliberative approach ensures that our research is complete and thoroughly vetted, and that our investment ideas are subjected to peer scrutiny before being recommended to a client. The outcome of every Investment Committee consideration of an investment manager is a formal rating of the manager.

Our asset allocation process is similarly grounded in research and experience. Sellwood creates and documents proprietary, forward-looking capital market assumptions using a methodology that considers current building blocks of future return rather than extrapolating past returns. Current valuations are an important component to all of our forward-looking assumptions, and we do not recommend asset classes for client portfolios without first considering the current valuation environment for the asset class. These assumptions are an important input to our asset allocation studies for clients, which combine traditional and non-traditional modeling and optimization techniques.

We conduct research for client-specific situations and inquiries as well as on a more general basis. We always publish the latter on our website, believing that investment research should always be subject to peer scrutiny.

![]()

Proven Manager Research

Our manager research philosophy is documented in our short white paper, “Common-Sense Investment Manager Research.” Our manager research effort seeks to identify active managers that have a high probability of outperforming in the future, based on proven drivers of outperformance that are rooted both in academic finance literature and our own experience. We insist on meeting with every investment manager, and understanding the manager’s philosophy and approach, before adding the manager to a client portfolio. While we consider the entire universe of investment managers, we recommend only a fraction of them.

Where the probabilities of active managers adding value after fees is low, we are not hesitant to recommend passive investment. One way we assess this probability is by using a methodology we developed and documented in “Using Active Share to Deliver Better Equity Portfolios.” Looking at the universe of active managers this way, we find that only a slender minority of them deserve our client’s attention or capital.

![]()

Uncompromising. And Uncompromised.

Sellwood’s ethics are second to none. Our firm always has been, and always will be, absolutely free from any conflicts of interest. We have no financial relationships with investment managers or service providers that we may recommend to clients. We do not accept revenue sharing, 12-b1 fees, or any other payments that would compromise our objectivity. 100% of our revenues are in the form of cash payments from our clients, which means that 100% of our advice is worth taking.

Sellwood is a Registered Investment Adviser with the SEC, and we serve as a fiduciary with respect to all of the services that we provide, meaning that our advice to clients must consider their interests first and foremost..

Our firm adheres to a strict internal Code of Ethics and all employees are bound by the CFA Institute Code of Ethics & Standards of Professional Conduct.

![]()

Customized Investment Solutions

While we operate under a defined Investment Philosophy for all clients, we approach each client individually, and we understand that no portfolio will be appropriate for all clients. We do not maintain model portfolios or employ cookie-cutter solutions. Before recommending an investment strategy to a client, we first seek to understand the client’s circumstances in all their complexity. It is only with this understanding that we can recommend portfolios that appropriately balance returns and risks for the specific client.

We have experience advising nonprofit clients with portfolios of short and long investment horizons, widely varying tolerances for risk and liquidity, ESG and socially responsible mandates, and differing spending policies. Being a boutique allows us to dig in and truly understand each client’s unique objectives and constraints, and develop customized portfolios that are responsive to them.

![]()

Experienced & Stable

We believe that stability of an investment advisory team is the most often overlooked factor in long-term investment success. There are rewards to long-term investment thinking, but those rewards can only be realized with a stable advisory firm and team. The best investment advice is provided by an experienced consultant, in the context of a long-term relationship. For these reasons, we have designed our firm and consulting team to be among the most stable in the industry.

Each of our client-facing consultants has at least 18 years of institutional investment advisory experience. We are 100% owned by our current employees, and our firm’s ownership is distributed broadly within the firm. Our ownership culture and governance mechanisms ensure that Sellwood will remain a viable partner to the clients we serve for years to come.

![]()

Your Outsourced Investment Staff

While we have worked successfully with asset pools of all sizes, we find that our firm is the most effective partner for plans with limited internal professional investment staffs. Our research, software, and database resources are industry-leading. Our model is to provide Boards and internal staff with the additional resources and expertise that come from our experience and scale. This partnership model combines Sellwood’s industry-leading tools with our years of experience working with charitable organizations to ensure optimal results for your endowment, foundation, or nonprofit organization.

![]()

Customized Discretionary (OCIO) Services

Some clients want only our advice, and others want us to both provide and implement our advice. We are comfortable under either approach, or anywhere in between. We believe that like investment advice, implementation discretion works best when it is customized to the client’s unique needs. We believe that discretion to implement investment decisions is not a binary “on or off” condition but instead exists along a spectrum, and we encourage our clients to consider which level of implementation services fits them best.

![]()

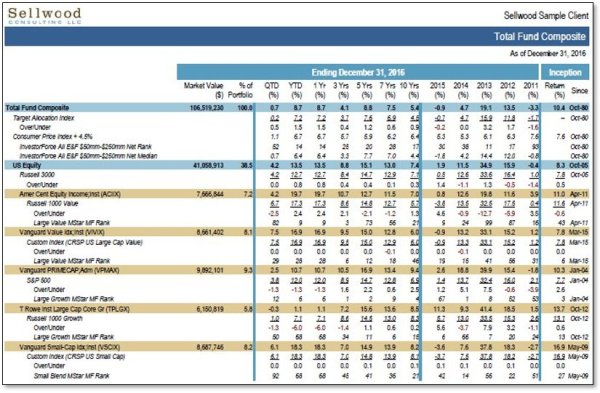

Industry-Leading Performance Reporting

Our performance reporting system, InvestorForce, is the premier investment analytics provider in the country. Unless our clients request otherwise, 100% of our performance reporting is presented net of investment fees, including the total plan’s composite return and all peer groups. Our peer groups are diverse and exceptionally robust, including several peer groups specific to endowments & foundations of various asset sizes.

![]()

The Sellwood Difference

Good advice arises from thoughtful structure. Our absolute freedom from conflicts of interest means that we sit on the same side of the table as our clients, and that our recommendations are always designed to benefit the portfolio. We bring large-firm experience and expertise, while retaining the client service focus of a boutique. Each of our consultants has at least 18 years of experience advising institutional clients, and continuity of our consulting team is a critical core value at Sellwood, meaning we offer clients unmatched stability in their consultant relationships. And our advice to clients is advice worth taking: we hold ourselves to the fiduciary standard of care for 100% of the services we provide to 100% of our clients.

We would be delighted to discuss Sellwood Consulting’s capabilities advising endowments, foundations, and charitable organizations with you directly. Please contact us to arrange an introductory meeting or call.