Download a PDF version of this white paper.

Download a PDF version of this white paper.

Executive Summary:

- Active Share is an important innovation that gives our industry a common method and language to define how “active” an active equity manager really is.

- Attention to Active Share enables lower-cost equity portfolios, and potentially better-performing ones.

- We propose a new metric, Active Fee, which evaluates the fees that active managers charge for the active component of their portfolios.

Active Share is a relatively recent innovation in investment analysis and, unlike many innovations in the investment world, one that we believe enhances the investment process. We use Active Share to quantify how “active” active managers really are, what level of fees are appropriate to pay those managers, and ultimately, we believe, to recommend better portfolios for our clients.

The Old Way

Consultants have always known that some investment managers are more active than others, but until Active Share came along, our industry had only rudimentary tools to quantify the degree to which an active manager was truly “active.” The most popular method, tracking error, measures how much a manager’s returns differ from those of the benchmark. Correlations and measured betas also gave hints as to how much a manager’s portfolio differed from the benchmark. Finally, a consultant could inspect a portfolio, comparing the manager’s top holdings to those held by the benchmark, to get a sense for the manager’s appetite for differing from it. All of these methods suffer from either being derivative of what the consultant is really trying to measure (measuring return variability is not the same as measuring holdings differences), or from imprecision. Without sharp tools, the investment community took to calling products with near-0% tracking error “index funds,” and the rest of the universe of products “actively managed funds.”

What is Active Share?

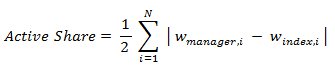

Enter Active Share. Defined as the percentage of an investment portfolio that is different from the index, this statistic provides a standard way to compare a manager’s holdings against its benchmark. Active Share is calculated as follows:

An index fund has Active Share near 0% because its holdings are designed to replicate the benchmark, both in count and in proportion. A perfectly active manager, with no holdings overlap with its benchmark index, scores 100% Active Share versus that index (in which case the benchmark should be questioned as a proxy for the manager’s strategy).

Active Share acknowledges that very few investment portfolios are 100% active or 0% passive. Every investment manager’s portfolio can be thought of as having two underlying components – the portion that replicates an index and the portion that is truly “active.” Active Share quantifies the latter portion.

An active manager may hold different securities than the index or hold securities that are in the index but at different weights. Active Share captures both of these active decisions and allows us to quantify not just whether a manager is “active,” but how “active” an active manager really is.

Active Share is purely descriptive in nature. High or low Active Share is neither desirable nor undesirable by itself. When combined with fees, however, Active Share becomes a potentially powerful indicator of manager desirability.

Transparency & Creativity Yield Better Portfolios

Active Share is one building block we use when evaluating the appropriateness of investment manager fees & expenses. Consider two hypothetical investment managers:

| Manager | Active Share | Passive Share | Cost |

|---|---|---|---|

| Closet Indexer Inc. | 10% | 90% | 1.00% |

| Active Capital Management LLC | 90% | 10% | 1.00% |

Assuming all else is equal, Active Capital Management has a much greater opportunity to beat its benchmark than does Closet Indexer. This is not to say that it will beat its benchmark, only that it has greater opportunity to do so. By contrast, Closet Indexer has very limited opportunity to beat its benchmark, because 90% of its holdings are the benchmark.

Now let’s add a third fund manager to the mix:

| Manager | Active Share | Passive Share | Cost |

|---|---|---|---|

| Index Fund | 0% | 100% | 0.05% |

This option will never outperform the benchmark – but then again, neither will 90% of Closet Indexer’s portfolio. The difference is that Index Fund charges 1/20th of the cost for the same outcome, for this 90% overlapping portion of the portfolio. Recognizing this, we can combine two of these options to produce a better portfolio:

| Portfolio | Active Share | Passive Share | Cost |

|---|---|---|---|

| 89% Index Fund / 11% Active | 10% | 90% | 0.15% |

Again assuming all else is equal, we obtain the same portfolio result as we would by hiring Closet Indexer – but at about one-sixth of the cost. When combined with research showing that fees are a significantly reliable predictor of manager net performance, this concept becomes pretty powerful in designing better portfolios.

Even better, there is evidence to indicate that all else is not equal. Recent research by Antti Petajisto has found that managers with higher Active Share and moderate tracking error have significantly outperformed active managers with low Active Share.

Active Share in Context of Manager Fees

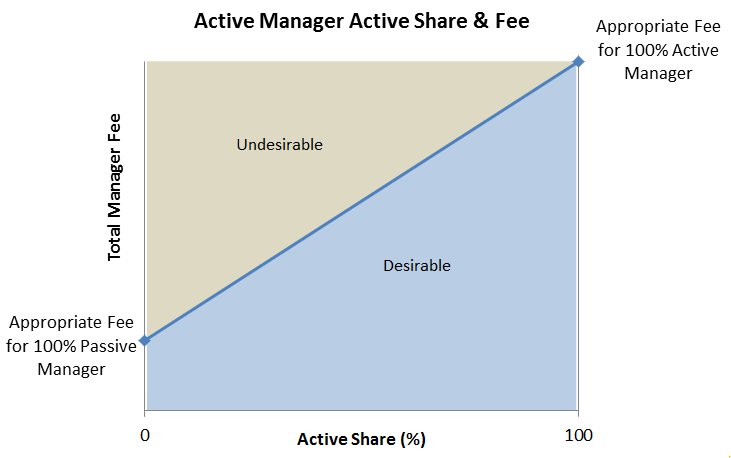

Examination of a portfolio’s Active Share permits advisors to discard the binary “active” and “passive” labels and more precisely situate investment manager portfolios along a spectrum between active and passive management. Of course, investment manager fees also exist along a spectrum. As we see it, active manager fees are only worth paying for active portfolios (by “active portfolios,” we mean the component of a manager’s portfolio that is truly “active”). Comparing a manager’s known Active Share and a known fee gives us a tool to assess how reasonable active manager fees are.

We know what index funds (Active Share ~ 0%) cost. We know what talented, truly active managers (Active Share > 90%) cost. Every other manager falls somewhere in between. We believe that their fees should be on or below the line that connects index funds to truly active managers:

Managers that fall above this line have an undesirable total fee when adjusted for Active Share, while managers below the line have a desirable fee when adjusted for Active Share.

Proposing “Active Fee”

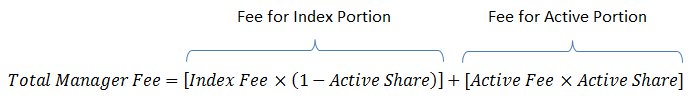

We can refine this concept even further. If every manager portfolio is a combination of an index portfolio and an active portfolio, so too is every manager fee a combination of a fee for the index portion of the portfolio, and a fee for the active portion of the portfolio:

– or –

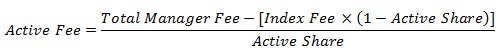

Re-arranging this equation to solve for Active Fee yields:

The Active Fee metric allows us to perform an apples-to-apples comparison of the fee being charged by managers on the active portion of their portfolios. It solves the problem of evaluating managers that are at different places along both the active management and fee spectrums. It strips out the noise (the “passive” component of an active manager’s portfolio) to evaluate the signal (the “active” component, and its cost).

Manager fees always represent a hurdle for the manager to overcome, before their strategy can add value for the client. Active fee calculates the height of this hurdle more precisely. It expresses the amount that the actively managed component of the manager’s portfolio must outperform to allow the entire portfolio to add value in excess of its fee.

For example, let’s assume an “active” manager that charges 1.00% of assets per year and that has an active share of 50%. Let’s also assume that an index fund is available in the same market segment, costing 0.05% of assets per year. The manager’s Active Fee is 1.95% per year. Investing with this manager only makes sense if you believe the active half of the manager’s portfolio is good enough to outperform the benchmark by 1.95% per year. Otherwise, the index fund would be a better choice.

One fallacy exposed by calculating Active Fee is that some managers charge a fee on all the assets that they manage on behalf of investors, but actively invest only a fraction of those assets. One opportunity that calculating Active Fee reveals is that some managers, with very high active share and reasonable fees, can be worth those fees.

Manager Active Share and Active Fee values change over time, particularly as talented investment managers attract more assets to manage. When we examine Active Share, we are careful to review its historical values for manager portfolios in addition to current point-in-time values. We also compare historical Active Share values to historical manager assets managed, both for internal research and in all of our equity manager searches for clients. Examining these data points in concert helps us to avoid recommending investment managers that have outgrown their ability to generate their past favorable track records.

Conclusions

Every investment manager’s portfolio is, and has always been, a combination of two portfolios – the index, and their active portfolio – in different proportions that depend on how “active” the manager is. Active Share brings transparency to the evaluation of active manager portfolios, allowing us to quantify the proportions of each inside an otherwise opaque investment manager portfolio. With Active Share, no longer do we need to resort to shorthand “active” or “passive” labels; instead we can appropriately situate managers on a spectrum between passive and active.

We believe that fees matter, but we are not opposed to our clients paying active manager fees. We only oppose paying active management fees for the indexed component of portfolios. Evaluating Active Share alongside manager fees allows us to separate managers that have an opportunity to outperform from those that only charge fees as if they do.

Finally, a new metric we propose, Active Fee, incorporates two data points that have been empirically associated with manager outperformance. Highlighting this new metric to our clients, we believe, sets them up for greater success selecting investment managers.

Further reading

- Active Share and Mutual Fund Performance, Antti Petajisto. 2013.

- The search for outperformance: Evaluating ‘Active Share’, Vanguard, 2012.

- Why Active Funds Outperform Closet Index Funds, Morningstar, 2011.

- On Persistence in Mutual Fund Performance, Mark M. Carhart. J. OF FINANCE, Vol. 52 No. 1, March 1997.