First Quarter 2024: Fresh Highs Just in Time for Spring

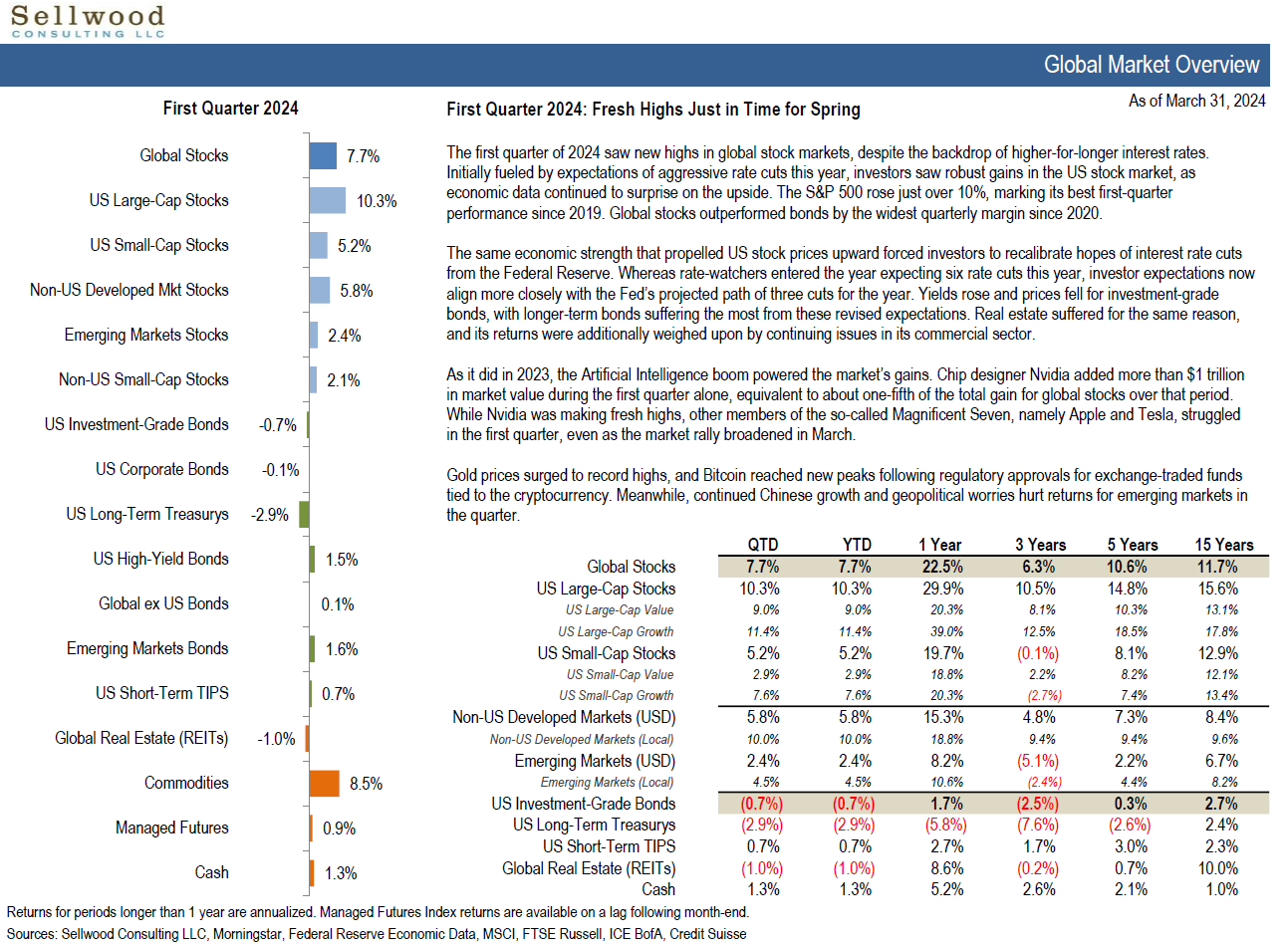

The first quarter of 2024 saw new highs in global stock markets, despite the backdrop of higher-for-longer interest rates. Initially fueled by expectations of aggressive rate cuts this year, investors saw robust gains in the US stock market, as economic data continued to surprise on the upside. The S&P 500 rose just over 10%, marking its best first-quarter performance since 2019. Global stocks outperformed bonds by the widest quarterly margin since 2020.

The same economic strength that propelled US stock prices upward forced investors to recalibrate hopes of interest rate cuts from the Federal Reserve. Whereas rate-watchers entered the year expecting six rate cuts this year, investor expectations now align more closely with the Fed’s projected path of three cuts for the year. Yields rose and prices fell for investment-grade bonds, with longer-term bonds suffering the most from these revised expectations. Real estate suffered for the same reason, and its returns were additionally weighed upon by continuing issues in its commercial sector.

As it did in 2023, the Artificial Intelligence boom powered the market’s gains. Chip designer Nvidia added more than $1 trillion in market value during the first quarter alone, equivalent to about one-fifth of the total gain for global stocks over that period. While Nvidia was making fresh highs, other members of the so-called Magnificent Seven, namely Apple and Tesla, struggled in the first quarter, even as the market rally broadened in March.

Gold prices surged to record highs, and Bitcoin reached new peaks following regulatory approvals for exchange-traded funds tied to the cryptocurrency. Meanwhile, continued Chinese growth and geopolitical worries hurt returns for emerging markets in the quarter.