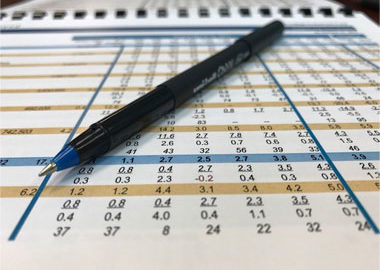

2024 Capital Market Assumptions

Download our 2024 Capital Market Assumptions Report. Sellwood’s 2024 Capital Market Assumptions represent our best current thinking about future returns. They are the essential building blocks of the asset allocation work we perform for clients. Our 2024 return and risk assumptions are presented below: We update our capital market assumptions annually. This year, we reduced … Continue reading 2024 Capital Market Assumptions