Note: These assumptions are now outdated. Our current capital market assumptions and our white paper documenting their construction can always be found on our Capital Market Assumptions page.

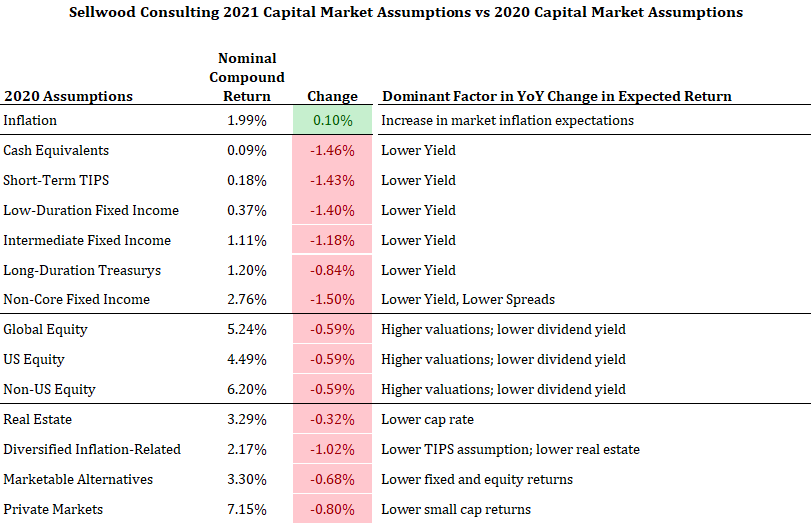

Sellwood Consulting’s 2021 Capital Market Assumptions contemplate a prospective lower-return environment, caused by last year’s declining yields and expanded valuations.

These 10-year, forward-looking assumptions of asset class return, risk, and correlation are the key input variables for our asset allocation work on behalf of clients.

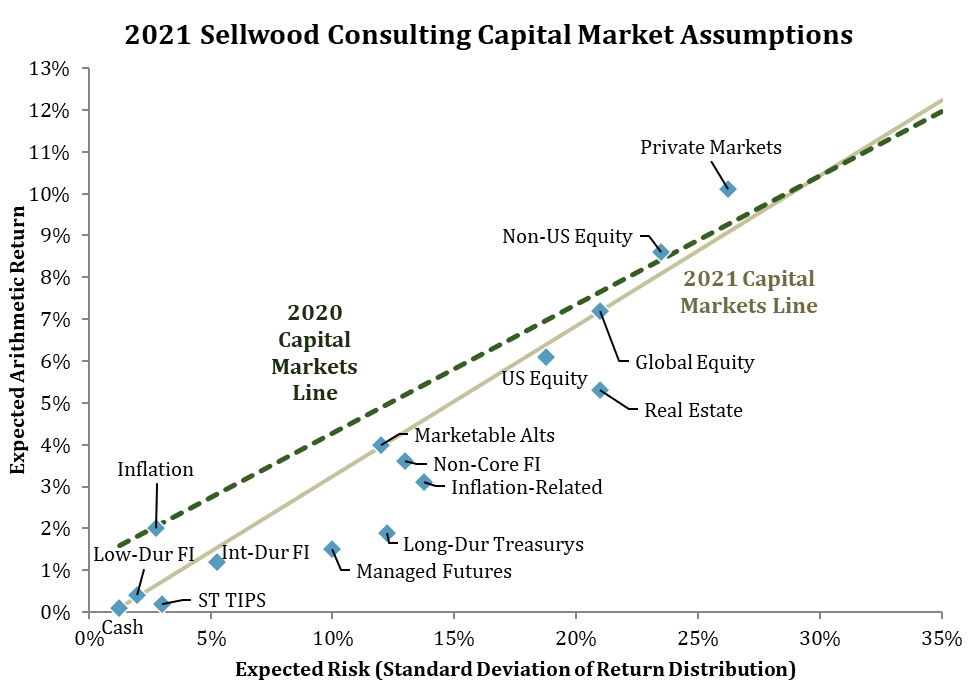

As a result of these updates, our 2021 forecasted “capital markets line,” depicting opportunities for investment return at varying levels of risk, has shifted downward and steepened. With last year’s unexpected collapse in short-term interest rates, return prospects for safe assets like cash declined substantially, while return prospects for riskier assets like stocks declined by a lesser amount. Our assumptions heavily depend on current market conditions, and low market yields simply don’t offer much in terms of future return. The dotted line represents the capital markets line implied by last year’s assumptions; the solid tan line is this year’s:

An Incredibly Challenging Time to Allocate

The changing shape of the capital markets line paints a frustrating picture for investors with return requirements north of zero. Whereas in the recent past, a 5% return could have been reasonably expected with a balanced portfolio of stocks and bonds, today the landscape is very different. As of the end of the year, cash and high-quality (safe) bonds yielded somewhere between about zero and one percent, and these low yields have pushed valuations for stocks upward, depressing their prospects for future return.

A portfolio that requires a 5% return, today, cannot allocate much of that portfolio to cash or high-quality bonds. A 5% return requirement therefore requires the assumption of a much more volatile portfolio than it did even a few years ago — and specifically, the assumption of much more equity risk, at a time when equity valuations are elevated. Alternatively, maintaining a balanced level of risk implies accepting the likelihood of a lower level of return.

What used to be a reasonable return expectation (5%) for a balanced-risk portfolio is today an unreasonable expectation at the same level of risk. Or alternatively: what used to be an unreasonable level of risk is what is now required to expect the same return.

Diversification helps, and not every market is as challenged in prospective return as US stocks and high-quality bonds. Many assets improve portfolios not so much via expected risk and return as with imperfect correlations of return, which reduces overall portfolio risk. Creativity can go a long way — but the table is set, and it is set for lower returns than we have seen over the last decade.