Fourth Quarter 2023: What Landing?

Pessimistic forecasts and a dour economic outlook set the stage for an unexpected stock bull market boom in 2023. Just over a year ago, Chairman Jerome Powell cautioned that “it is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy. We will stay the course until the job is done.” In the shadow of nearly 9% inflation, Powell faced a daunting challenge, and the prevailing economic debate revolved around the trade-off between economic pain and taming soaring prices.

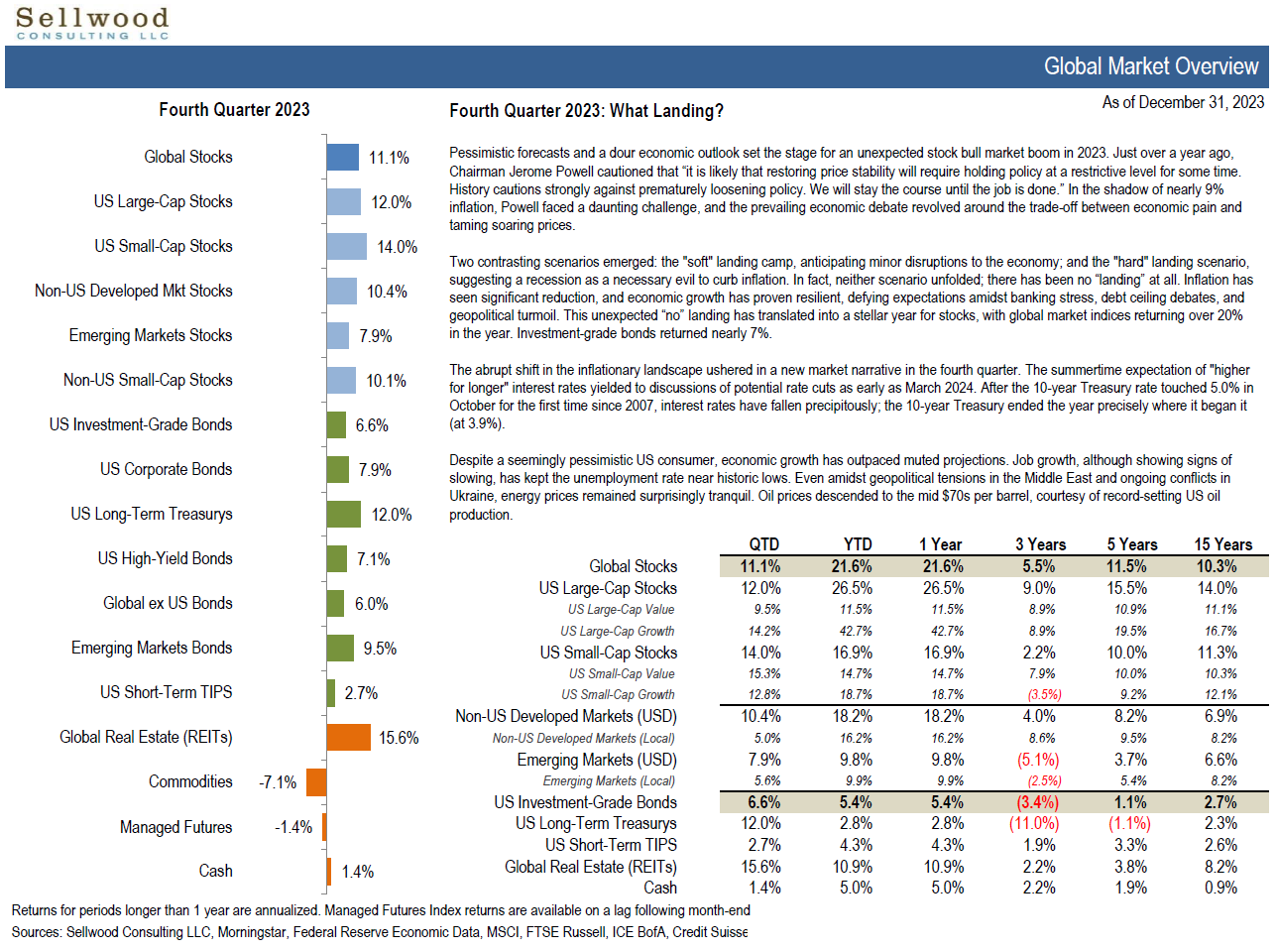

Two contrasting scenarios emerged: the “soft” landing camp, anticipating minor disruptions to the economy; and the “hard” landing scenario, suggesting a recession as a necessary evil to curb inflation. In fact, neither scenario unfolded; there has been no “landing” at all. Inflation has seen significant reduction, and economic growth has proven resilient, defying expectations amidst banking stress, debt ceiling debates, and geopolitical turmoil. This unexpected “no” landing has translated into a stellar year for stocks, with global market indices returning over 20% in the year. Investment-grade bonds returned over 5%.

The abrupt shift in the inflationary landscape ushered in a new market narrative in the fourth quarter. The summertime expectation of “higher for longer” interest rates yielded to discussions of potential rate cuts as early as March 2024. After the 10-year Treasury rate touched 5.0% in October for the first time since 2007, interest rates have fallen precipitously; the 10-year Treasury ended the year precisely where it began it (at 3.9%).

Despite a seemingly pessimistic US consumer, economic growth has outpaced muted projections. Job growth, although showing signs of slowing, has kept the unemployment rate near historic lows. Even amidst geopolitical tensions in the Middle East and ongoing conflicts in Ukraine, energy prices remained surprisingly tranquil. Oil prices descended to the mid $70s per barrel, courtesy of record-setting US oil production.