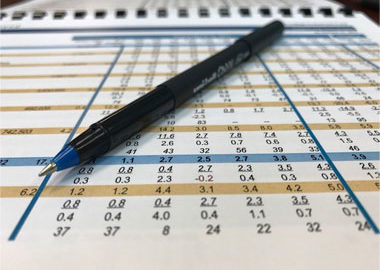

2020 Capital Market Assumptions

Note: These assumptions are now outdated. Our current capital market assumptions and our white paper documenting their construction can always be found on our Capital Market Assumptions page. Sellwood Consulting’s 2020 Capital Market Assumptions contemplate a prospective lower-return environment caused by last year’s extraordinary valuation expansion in nearly every asset category. These 10-year, forward-looking assumptions of asset class … Continue reading 2020 Capital Market Assumptions