Note: These assumptions are now outdated. Our current capital market assumptions and our white paper documenting their construction can always be found on our Capital Market Assumptions page.

Sellwood Consulting’s 2018 Capital Market Assumptions are available. These 10-year, forward-looking assumptions of asset class return, risk, and correlation are the key input variables for our asset allocation work on behalf of clients.

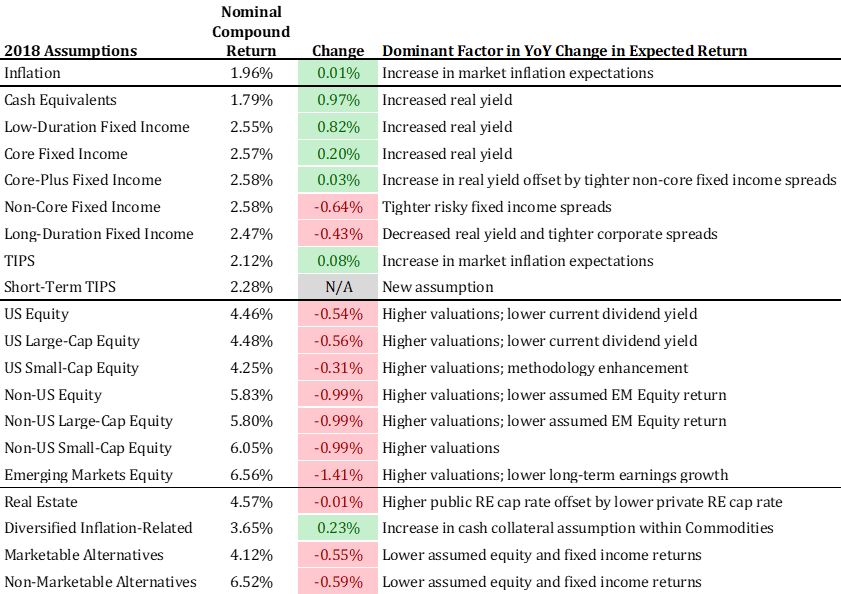

We update our assumptions annually. Over the course of 2017, investors’ shifting preferences away from bonds and toward risk-seeking assets caused valuations for risky assets to expand, fixed income spreads to tighten, and yields for shorter-term Treasury bonds to rise. Updating our assumptions for 2018, we forecast lower returns for every equity category, and higher returns for most fixed income categories, than we did last year.

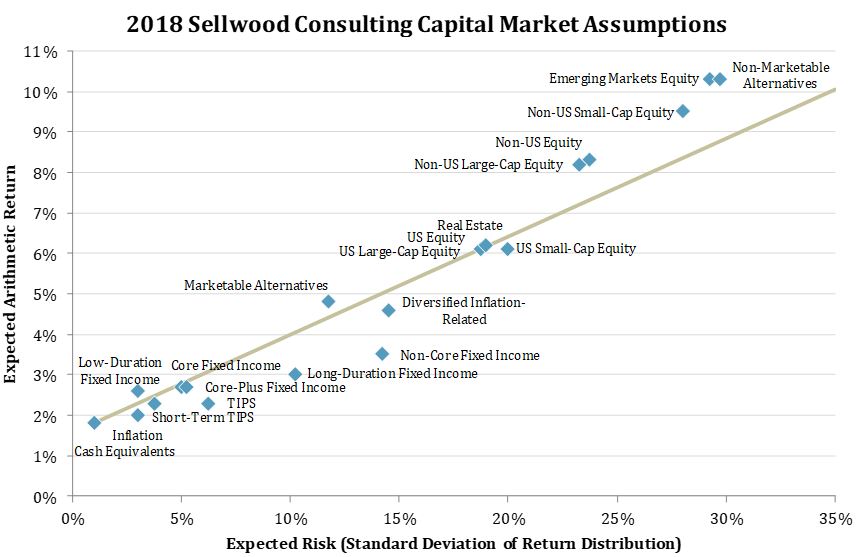

As a result of these updates, our forecasted “capital markets line,” depicting opportunities for investment return at varying levels of risk, has flattened: we believe that over the next ten years, investors will not be as compensated for taking risk as they have been in the past. In the case of fixed income, higher real yields bring greater opportunity for return with lower risk. For risky assets, like global equities, the market experience of 2017 brought higher valuations, which pull return from the future into the past.

Within equities, it is no coincidence that the markets that experienced the largest gains in 2017 saw the largest declines in forward-looking assumed return under our valuation-based methodology. Even after these changes, our modeling suggests that investors will be well served to diversify their equity exposure outside the United States. Emerging Markets equity remains the asset class with our highest expected return, albeit with our highest forecasted risk amongst equity categories.

Within fixed income, our analysis presumes that interest rates will rise. Consequently, we forecast that duration risk will not be compensated. We expect that nominal bonds between low and long duration will experience roughly similar returns over the next decade.

This year, we made two changes to our methodology. First, we added a short-term TIPS assumption, to go alongside the TIPS assumption that has been included in our assumption set as long as it has existed. Our methodology for this assumption is consistent with our methodology for all other fixed income assumptions. Second, we improved the methodology that we use to forecast US small-cap returns. Details can be found in our white paper. All other changes to our assumptions simply reflect new information that the market provided us in 2017.