“Our research department believes that the President’s agenda will stall in Congress, the Fed is on pace for two more rate hikes this year, and that we are seeing really promising economic growth out of Asia. As a result, we recommend that you shift a bit of money out of core bonds and into international equities for the next six months.” “The futures market is flashing a panic signal, so we are going to de-risk your portfolio for a while and wait out this storm.” “Valuations are getting a bit stretched in REITs. We should remove them from the portfolio.” “Our tactical model recommends a near-term overweight to small-cap.”

Statements like these sound compelling. Unfortunately, they are absolutely the wrong way to design a portfolio.

To understand why, we must take a few steps back and start not with the portfolio but the client. Every client’s portfolio has a purpose, an objective, a reason for being. Pension plans exist to ensure that funds are available in the future to pay promised benefit payments. Defined contribution plans exist to provide participants the tools they need to map a financial future. Endowments set aside long-term assets to provide stability and enrichment to the operation of the associated nonprofit.

In other words, portfolios never exist in a vacuum, and investing them is never an end unto itself. Before investing a single dollar of a client’s portfolio, the first necessary question to ask is: why does this portfolio exist? Only after doing so can a proper investment strategy be established. Without knowing a portfolio’s purpose, investing a portfolio resolves to a purely academic exercise.

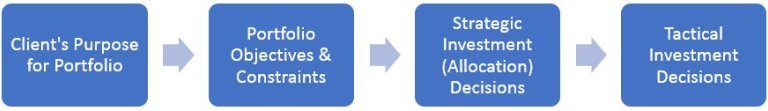

Instead, we propose the following framework for designing an optimal investment portfolio for an institutional client. First, the client’s purpose of the portfolio – the reason it exists — must be assessed. Then, the specific objectives and constraints of the portfolio must be taken into account, to provide guidance for portfolio design. With this information, we can use the tools at our disposal to construct a strategic investment portfolio that addresses its purpose, objectives, and constraints. Finally, tactical decisions can improve outcomes at the margin.

When we assess a client’s portfolio, we start on the left side of this diagram and move rightward. We believe that strategic decisions flow from client-specific purpose, objectives, and constraints, and that tactical decisions should be pursued in service of those strategic decisions. We believe that tactical decisions cannot be properly made unless, and until, all of the other questions have first been addressed.

Another approach, favored by many investment advisors with different philosophies, is to start at the right side of the diagram and move leftward. We believe this is the wrong way to design a portfolio. Let us examine why.

“Tactics Win Battles. Strategy Wins Wars.” – Pierce Brown

We differentiate strategic from tactical decisions by asking whether or not they acknowledge and take into account the portfolio’s specific purpose, objectives, and constraints. If they do, then they are strategic; if they do not, they are tactical.

Let us illustrate with two examples of how a client might end up with the same 40% equity allocation in the portfolio:

- A strategic (left to right) process

The portfolio is an open defined benefit pension plan (purpose), meaning that future liabilities will grow with the sponsor’s employee headcount and with their wages (objective). A 40% equity allocation provides a hedge against this method of liability growth (strategic decision). We should choose manager “X” rather than manager “Y” to manage those equities (tactical decision).

- A tactical (right to left) process

Because the Fed will only raise rates twice this year, and because the unemployment rate is low, and domestic manufacturing is enjoying a renaissance, we believe that we know better than the market does that equities will rise over the coming year; therefore all our client portfolios should have 40% in equities (tactical decision). We think that this portfolio will suit an open pension plan (objective) because over time it has equity-like risk. We like manager “X” to manage the allocation (tactical). Next year, the data will be different, and so will our portfolio (tactical again).

While both portfolios ended up with the same equity allocation, we suggest that the first got there with methodical analysis – a strategic asset allocation plan that considered the client’s unique characteristics – and the latter got there by accident. The second approach may have been equally methodical, and it arrived at the decision to have 40% in equities for a variety of reasons, but none of them had anything to do with the client. The inputs to a tactical asset allocation strategy are fundamentally incompatible with customized, client-centric portfolio design. There is no room in a tactical asset allocation approach for input about the client portfolio – all of the input variables are related to market forecasts.

Situating Risk Appropriately

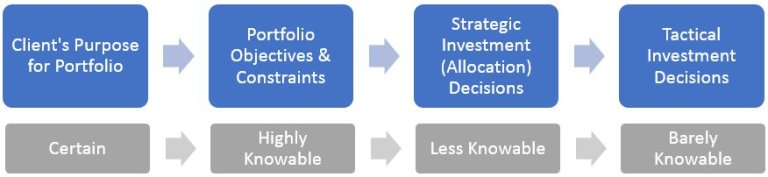

We believe that the importance of investment decisions diminishes as you move from left to right on the chart. Fully understanding a client’s return objective is going to affect client outcomes more meaningfully than the selection of US or European equities to fill the equity portion of a portfolio. Incorrectly measuring client risk tolerance tempts portfolio disaster, whereas selecting a sub-optimal rebalancing strategy risks mere discomfort. A left-to-right investment process works well in practice, because though client-specific portfolio purposes, objectives, and constraints can be difficult to tease out, they are fundamentally knowable. Investing within a left-to-right portfolio design framework concentrates the most impactful portfolio decisions where the inputs can be determined with the highest relative certainty. This is a strategy for placing the biggest bets where they are most likely to be rewarded.

Contrast this with right-to-left portfolio design approaches – made up of decisions that favor one security over another, or one market over another, or decisions based on political events or monetary policy. These decisions are based on inputs that are inherently unknowable and thus riskier, especially after considering that to succeed in making those decisions, one must not only be right, but more right than the market is. Starting with tactical decisions inappropriately situates the source of client/portfolio risk where it is least likely to be compensated.

In contrast to our preferred framework, where the most impactful portfolio decisions are concentrated in the most knowable areas of portfolio purpose, objectives, and constraints, a tactical asset allocation approach concentrates those risks where portfolio decisions are most unknowable and tenuous. While never easy, it is far easier, and therefore introduces less investment risk, to know a client’s liquidity needs and risk tolerance than it is to pick one market over another or forecast interest rates more correctly than the market does.

Tactical Scales, and Sells

Why do some practitioners employ a right-to-left process for allocating a portfolio? Because it’s easier! And more fun! And more profitable! Who wouldn’t want to skip past all the boring discussions of client liquidity tolerance, time horizon, and legal restrictions, and go straight to the fun part – thinking about relative valuations, politics, and the investment implications of whatever is in the latest issue of The Economist? And why take all the time to understand unique client needs when you can instead design a single one-size-fits-all tactical strategy that you can market to everyone?

This approach may work well for the advisor, but we are convinced it does not work well for the client. It occurs to us that tactical asset allocation is, fundamentally, a generic approach to investing, at dramatic odds with the client-customized approach we favor. If one’s investment process takes as its inputs things like congressional politics, or the level of the VIX index, or forecasts of economic growth rates in Asia, the process necessarily excludes any consideration of the client and the portfolio’s unique needs.

A tactical asset allocation “strategy” is not “strategic” at all, if we accept that strategy flows from client-specific objectives and constraints. It is, according to our diagram, as far removed from the client and the client’s unique needs as it could be.

Because of this, any tactical portfolio design approach carries the substantial risk of allowing the portfolio’s overall asset allocation to become inconsistent with its long-term objectives. Most portfolios have a long-term set of liabilities that the portfolio exists to match. If the tactical model indicates an allocation that deviates substantially from the expected return of these liabilities, not only does the model’s forecast risk being incorrect, but the portfolio risks underperforming the very liabilities it is intended to hedge. It risks neglecting the very purpose for which it exists.

Why Are Tactical Pitches Persuasive?

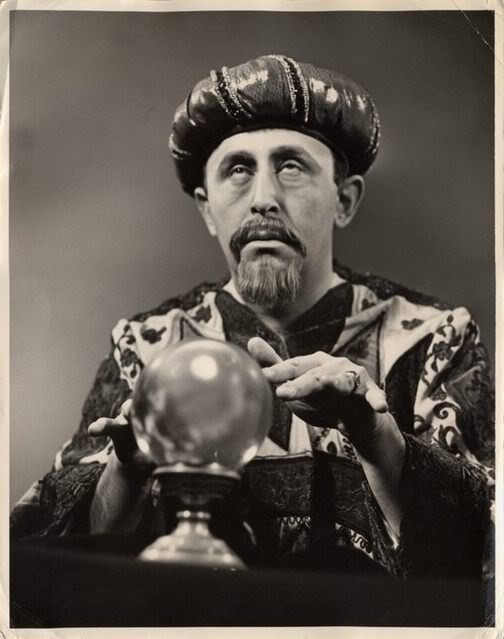

The world can be a scary place, and portfolios are very important to the clients that own or sponsor them. Innately, we want to believe that an uncertain world is knowable. We want to think that there are genius forecasters who know which direction the stock market will go this year, or how many times the Fed will raise rates this cycle, or how to invest a portfolio based on Asian GDP growth.

The world can be a scary place, and portfolios are very important to the clients that own or sponsor them. Innately, we want to believe that an uncertain world is knowable. We want to think that there are genius forecasters who know which direction the stock market will go this year, or how many times the Fed will raise rates this cycle, or how to invest a portfolio based on Asian GDP growth.

There may be some people who do know some of these things. In aggregate, however, forecasters are notoriously terrible. Study after study, most notably Tetlock’s landmark Expert Political Judgment, have proved predictions of the future of all types –weather, politics, and yes, financial markets – extremely unreliable.

Perhaps some tactical asset allocation strategies work. But put simply, we believe that portfolios should never be designed using inputs that are extremely unreliable.

Falling Apart Under Scrutiny

“We have long felt that the only value of stock forecasters is to make fortune-tellers look good.” — Warren Buffett

Despite all evidence, perhaps one reason that tactical investment approaches persist at the level of client overall portfolios is that clients who own them aren’t aware that they aren’t working. Tactical investment approaches are inherently difficult to benchmark. If the nature of an investment approach is to vary allocations between assets, it is very difficult to assess whether the manager has done a good job doing so, because the composition of benchmarks cannot incorporate the manager’s tactical decisions. It’s harder still to assess whether the manager has done a good job based on good luck or repeatable skill.

We suggest that quality of performance reporting is essential for monitoring the efficacy of any asset allocation program, tactical or not. We have seen many plan sponsors allow their advisor to propose or implement tactical decisions without a reporting structure in place to evaluate the outcomes of those decisions. In most cases that we have seen, the introduction of comprehensive reporting and attribution have revealed that tactical decisions at the portfolio level have subtracted, not added, value.

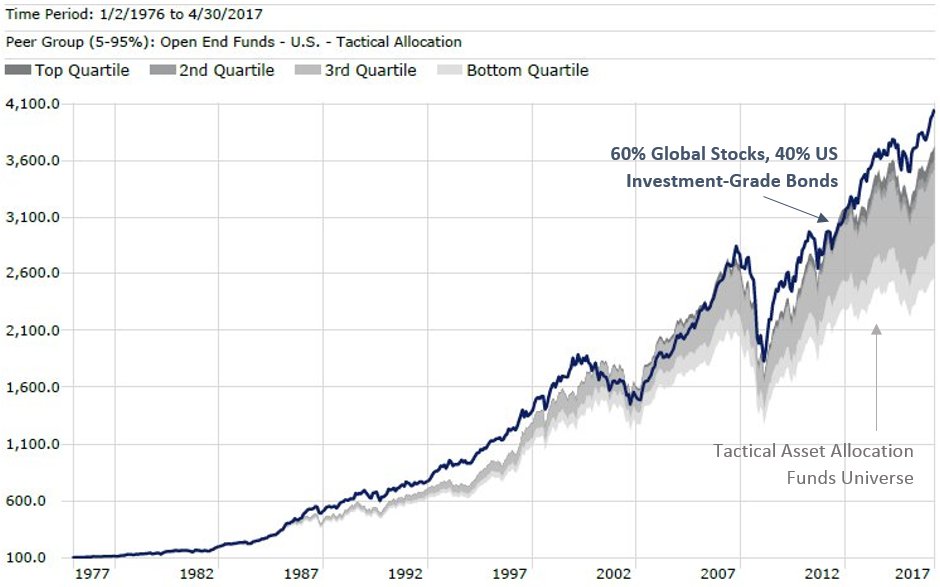

Tactical asset allocation strategies have existed in mutual fund form for decades. The following chart depicts the entire universe of “Tactical Allocation” funds, as reported by Morningstar, back to the universe’s inception in 1976. The gray area represents that fund universe. Although it is difficult to benchmark these types of strategies, we have compared them against a simple portfolio consisting of 60% global stocks (MSCI ACWI) and 40% US investment-grade bonds (Bloomberg Barclays Aggregate), represented by the blue line. Not a single tactical allocation fund has outperformed this simple benchmark over the long term. Nor did the universe of tactical strategies offer much portfolio benefit in any meaningful market decline – including 1998, 2000, or 2008– in their history.

Source: Sellwood Consulting, Morningstar Direct.

Additional challenges present themselves when considering tactical asset allocation programs for institutional clients. Not only does the analysis of any tactical portfolio decision have to be correct twice (on both the buy and sell, or sell and buy, decision – a very tall order), but the execution and evaluation horizon must be matched to the often-uncertain schedule of an institution’s Board and other governance structures. In our experience advising institutional clients, the disadvantages inherent in a tactical asset allocation (TAA) program at the portfolio level are most often too difficult to overcome.

Maybe, in Limited Doses

This is not to say that we do not find portfolio value in multi-asset portfolio strategies that allocate in ways other than with client-centered strategic allocations. In fact, we do find that client portfolios benefit from some of these approaches in measured doses. The fact that their approaches to asset allocation differ from our own provide benefit to the client in the form of diversification and risk mitigation. We have many clients who employ managers of multiple asset categories, in rotating or value-based allocation strategies that some might call “tactical” in nature.

But we maintain that these types of strategies would never be appropriate for a client’s entire portfolio, because whatever the inputs to their allocation – value, momentum, etc. – those inputs never take specific individual client circumstances into account. It is fundamentally inconsistent, and we believe impossible, to design a tactical asset allocation approach to offset a client’s specific set of liabilities. The liabilities themselves are never tactical, so therefore neither should the portfolio that hedges or offsets them.

Tactical may add value, but only at the margin. In our framework, it should be the last step of an allocation process, not the first. It should be the servant of a strategic allocation approach, not its master.

Back to Basics: A Client-Centered Approach

We do not believe in tactical management of client portfolios, at the plan level. Instead, we have had success recommending individual multi-asset managers to clients, to provide the overlay of a different allocation method to the portfolio, at a reasonable cost, and always in service of the broader strategic portfolio aim.

We note that our dynamic approach to asset allocation is designed to capture the same inefficiencies that a tactical approach purports to, only without the risks described above. Constructing a portfolio using realistic, well documented, frequently updated, long-term capital markets assumptions that are anchored in market fundamental forces (as ours are) delivers portfolios that change as markets do, but remain firmly connected to the essential, unique structures of each client and their portfolios. As well, a disciplined rebalancing approach, which we recommend to every client, takes advantage of shorter-term market dislocations or opportunities – much as a tactical approach might – without introducing the risks that a tactical approach would.

Ultimately, we believe that every portfolio decision – especially one as consequential as asset allocation – needs to take into account the broader picture of the client and their portfolio. The elements that make up this broader picture are not always readily apparent. They can be difficult to decipher. But uncovering them makes the difference between a portfolio that meets the client’s needs and one that only pretends to.

The work is harder, and the cocktail-party conversations less interesting, but the results are worth it.

Further Reading:

- Tactical Allocation Funds: Even Worse Than Expected (Morningstar, 2016)

- Elements of an Investment Policy Statement for Institutional Investors (CFA Institute, 2010)

- Expert Political Judgment (Philip E. Tetlock, 2005)

- Everybody’s an Expert (The New Yorker, 2005)

- How to Be Less Terrible at Predicting the Future (Freakonomics Radio, 2016)