Note: These assumptions are now outdated. Our current capital market assumptions and our white paper documenting their construction can always be found on our Capital Market Assumptions page.

Sellwood Consulting’s 2017 Capital Market Assumptions are available. These 10-year forward looking assumptions of asset class return, risk, and correlation are the key input variables for our client asset allocation work.

Our process for creating the assumptions incorporates market-based information, so when markets move, our assumptions do as well. We revisit our forward-looking assumptions annually based on changes in underlying variables over the course of the prior calendar year. Over the course of 2016, we saw:

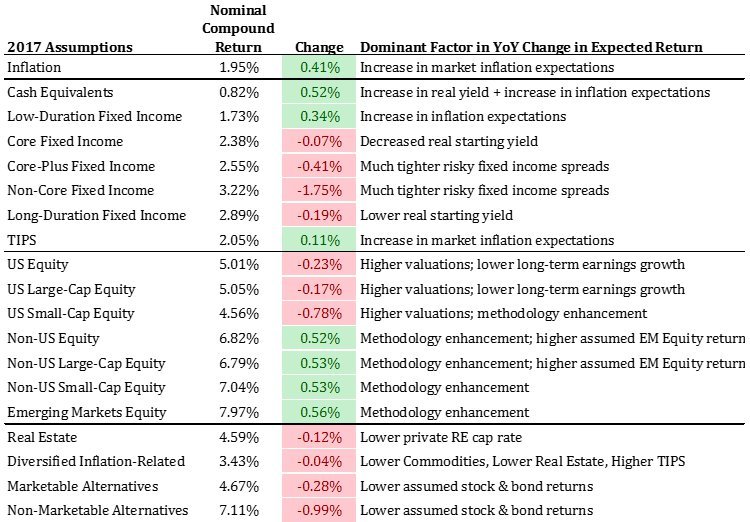

- A rise in inflation expectations, which, all else equal, tended to increase our return assumptions across the board;

- A flattening of the real (after-inflation) US Treasury yield curve, causing higher return forecasts for shorter-term fixed income and lower return forecasts for longer-dated bonds;

- Higher valuations in the US equity market, as stock prices, especially in small cap, rose faster than earnings did; and

- Relatively unchanged valuations in the international equity markets.

The following chart depicts Sellwood’s 2017 compound return assumptions, relative to those we created for 2016:

This year, we updated our methodology for assuming long-term earnings growth rates, a core building block of expected return, for all equity categories except US Large-Cap Equity. Our updated methodology provides us with higher confidence of the forecast because it relies more on relationships to US Large-Cap Equity, where we have more than a hundred years of robust data, than the absolute values implied by shorter data series. The methodology change contributed to lower return forecasts for US Small-Cap Equity (and consequently, US Equity) but a higher return forecast for Emerging Markets Equity (and Non-US Equity, Non-US Large-Cap Equity, and Non-US Small-Cap Equity). These methodology changes are outlined in detail in our white paper documenting the 2017 Capital Market Assumptions.

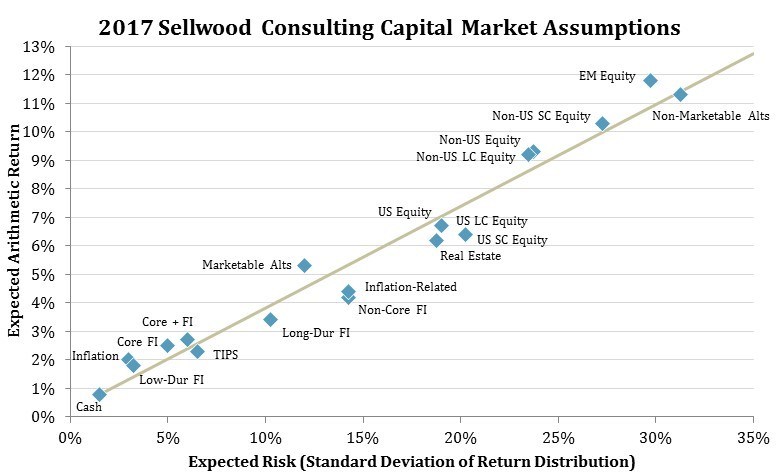

Presented in annual arithmetic average terms, our 2017 assumptions are depicted in the following chart:

Our assumptions continue to imply a prospective low-return environment for financial assets relative to historical averages. Further evidence of this environment has recently been highlighted by several credible industry researchers. Our assumptions are consistent with this analysis. Please also see our post, Realism in Forecasting, which explains our comfort with having forecasts outside the range of many of our peers.

Though we have made incremental enhancements to our methods for gauging the future value of assets, we have maintained our focus on the primary, reliable drivers of risk and return. Our assumptions are anchored in the empirical facts presented by long-term capital markets rather than speculative observations on recent market conditions. We avoid unnecessary complexity, preferring instead to rely upon transparent strategies that work reliably. Our analysis is comprehensive, but not complicated, because we are convinced that the most robust solutions have no hidden constraints and few moving parts. These same principles – pragmatic research and simplicity in execution – guide all of our work for clients.

We invite you to review our updated 2017 Capital Market Assumptions white paper.