Readers of our 2013 Capital Market Assumptions will note that our return expectations are in many cases lower than the expectations that our consultant peers publish. We are aware that our assumptions are different from the crowd, but we believe that our assumptions are more grounded and realistic than those published by the majority of our peers.

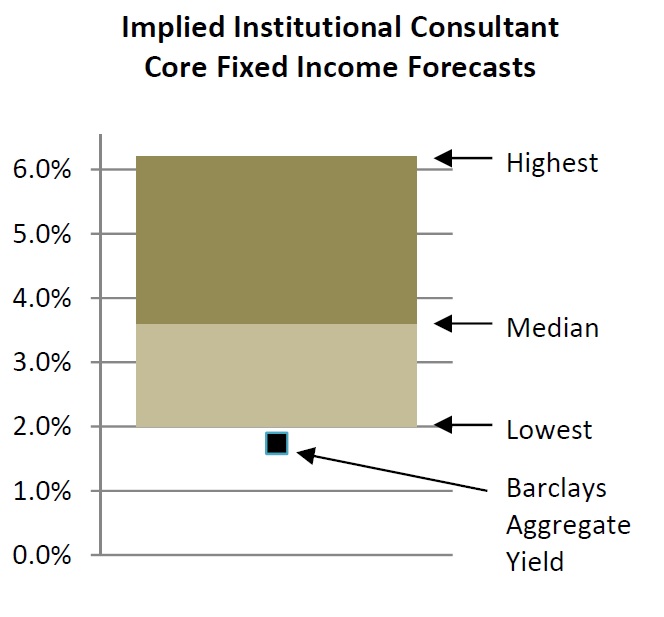

Let us take Core Fixed Income as an example. According to the 2012 Survey of Horizon Capital Market Assumptions, the median consultant return forecast for the asset class is 4.1%, with the range between highest and lowest 2.5% to 6.7%. It should be noted that the participants in the survey are not industry unknowns — they are a collection of well-regarded consulting firms, together advising trillions of dollars of institutional assets.

To be fair, the 2012 Horizon survey uses consultants’ forecasts from the beginning of 2012, when the yield on the Barclays Aggregate Bond Index, widely acknowledged to be a reasonable proxy for the asset class, was approximately 0.50% higher than it is today. If we assume that consulting firms generally decrease their return assumptions along with yields, the current range would be approximately 2.0% to 6.2%, with the median forecast approximately 3.60%.

To be fair, the 2012 Horizon survey uses consultants’ forecasts from the beginning of 2012, when the yield on the Barclays Aggregate Bond Index, widely acknowledged to be a reasonable proxy for the asset class, was approximately 0.50% higher than it is today. If we assume that consulting firms generally decrease their return assumptions along with yields, the current range would be approximately 2.0% to 6.2%, with the median forecast approximately 3.60%.

This assumption that consulting firms change their assumptions along with markets may, however, prove unrealistic – because it is clear to us that the range of other consulting firms’ assumptions does not reflect the reality of current low yields.

Compare this range of forecasts to the yield on the Barclays Aggregate Bond Index. As of December 31, 2012, that yield was 1.74%. This yield means that the expected return for the index, over the time until its maturity, is 1.74%, less any losses from securities in it that default.

It is possible, of course, for the actual return that is experienced in the future to be greater than the current yield – if interest rates were to change. An investor in the index could experience a return higher than the current yield under one of two scenarios: first, if yields were to decline at the end of the forecast period, or if yields were to rise at the beginning of the forecast period. Here, we test those two scenarios, holding all variables except the index yield constant.

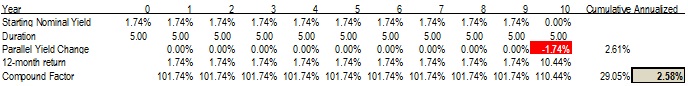

Scenario 1: Barclays Aggregate yield holds steady (no change) for 9 years, and then declines to zero in tenth year:

This scenario results in a return higher than the current yield: 2.58% annualized over the next ten years. It relies upon the assumption, so unlikely as to be impossible in our view, that yields never change until the tenth year, and then fall all the way to zero, precisely in the tenth year. 2.58% annualized serves as a ceiling on return under this scenario — should the yield decline in the tenth year by any amount less than all the way to zero, the return would be lower.

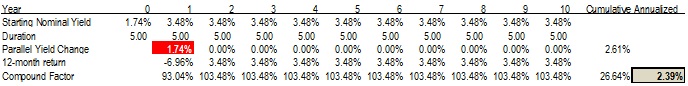

Scenario 2: Barclays Aggregate yield rises sharply (doubles) in year one, and then never changes again in remaining 9 years:

This also results in a return higher than the current yield, at 2.39%. To get a return forecast that high, you need to make the assumption, unrealistic in our view, that yields double from current levels, all in the first year of the ten-year forecast period, and then never change again.

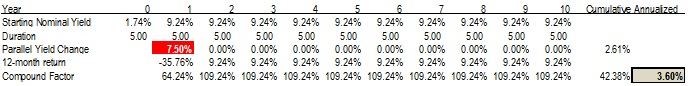

What would it take for an index yielding 1.74% to experience an annualized return over the next ten years of 3.60% (our assumed median consultant forecast for it)?

We know that yields can’t fall below zero, so Scenario 1 can’t get us there. But we can engineer a scenario under Scenario 2 – a dramatic, immediate, rise in yields – that will. The answer is that it would take an immediate 7.50% rise in yields, and then no change in yields for the next nine years, for this forecast to be possible.

We are nothing if not humble when it comes to predicting the future. But we are willing to go out on a limb and predict that yields on the Barclays Aggregate will not rise to 9.24% this year, and then never change again for the next nine years. (The last time the yield on the index was that high was in 1989.)

One possible explanation, it should be noted, for the apparent impossibility of our peers’ return forecasts could be the time horizon they assume. At Sellwood, we believe that it is essential to define a horizon for investment when defining the forecast. It is possible that several of our peers have defined much longer forecast periods than ten years, which would make their return forecasts slightly more likely (but at a cost of being less relevant to portfolio construction today). It is also possible that several peers have not defined their forecast periods. If your horizon is undefined, you can assume whatever you want to.

As such, we know that our assumptions are different from our peers – but we believe that the return assumptions that our peers deliver rely on underlying propositions – implied forecasts – that are simply unrealistic. Further, we believe that reliance on assumptions that are not realistic leads to the construction of portfolios that are not optimized for success.

We are reminded of two of our favorite quotes, when it comes to forecasting:

"Prediction is very difficult, especially if it's about the future." -- Nils Bohr, Nobel laureate in Physics

… but also,

"Something that can't happen, won't happen." -- Herbert Stein, Economist (paraphrased)

We hate to be the bearers of bad news in the form of predicting lower returns. But we’d rather be right with dismay than wrong, smiling.