A number of recent articles and research pieces have caught our eye, reinforcing our belief that forward-looking returns will be challenged by current low yields in marketable asset classes — low dividend yields in equities, and low coupon yields in fixed income.

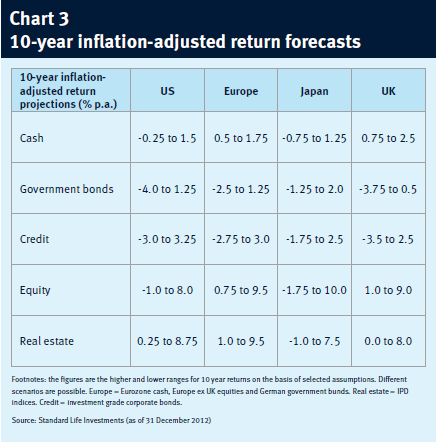

A recent article from Buttonwood’s column in The Economist, “Home on the Range,” is a cogent summary of a recent study by Standard Life Company. The article notes,

“The biggest mistake investors make is extrapolation. American pension funds often assume future annual returns of 7.5% or 8% because they have achieved those figures over the past 30 years. But the starting-point for such calculations is 1982, when Treasury-bond yields were in double digits and the dividend yield on US equities was 6.2%. Such returns are far harder to achieve when the starting yields on both assets are around 2%.”

The article cites a recent study by Standard Life that projects relatively low returns for financial assets in the coming ten years.

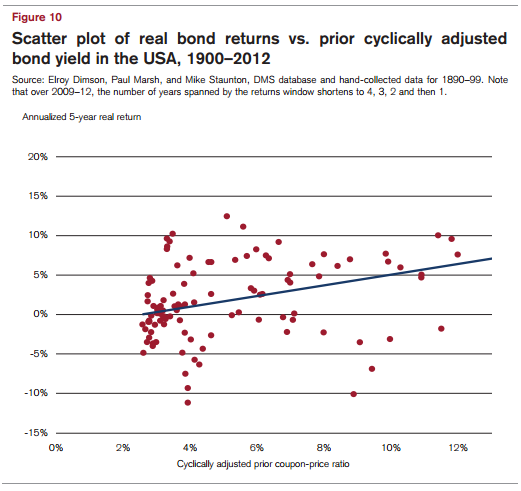

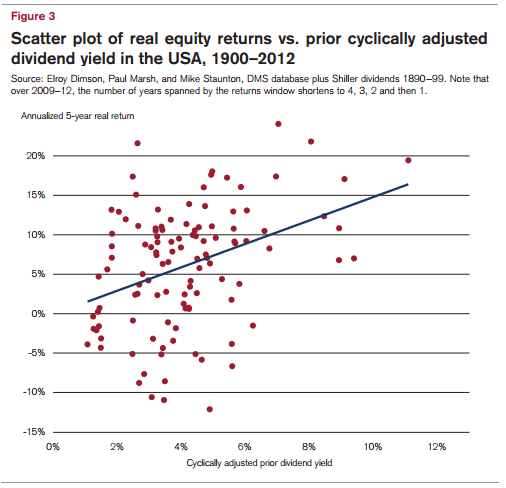

Credit Suisse has just published its 2013 Global Investment Returns Yearbook, which annually updates the important research of Dimson, Marsh, and Staunton on long-term investment returns. This year’s focus is on prospective asset returns in low-interest rate environments. The following charts illustrate the prospective returns to stocks and bonds at various going-in income yields for US stocks and bonds, back to 1900. The positive slope of each trend line (in blue) illustrates the relationship between yields and future return — when yield is low, so too tends to be the prospective return.

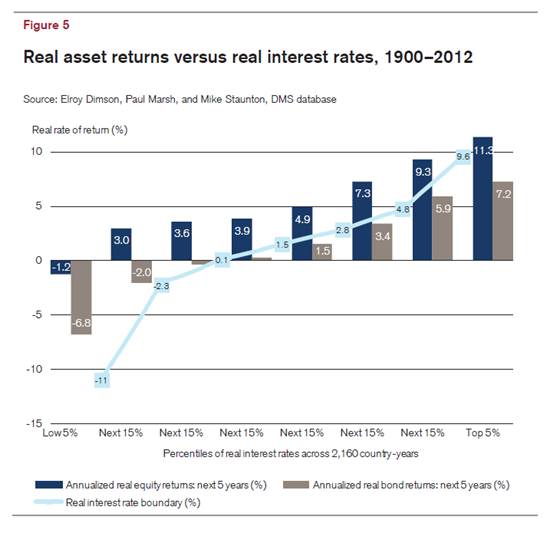

Finally, from the same Credit Suisse study, the following chart compares asset returns to interest rate environments and finds a similar positive relationship between the overall level of interest rates (here, separated by percentiles of rate environments) and prospective asset returns.

We believe that any single metric should be viewed with appropriate skepticism — there are plenty of good reasons that many market participants are optimistic about the future for capital market returns. But at the very least, if history is any guide, we believe that it advises caution against expecting high levels of return from the current low levels of yield found in traditional asset markets.

We believe that any single metric should be viewed with appropriate skepticism — there are plenty of good reasons that many market participants are optimistic about the future for capital market returns. But at the very least, if history is any guide, we believe that it advises caution against expecting high levels of return from the current low levels of yield found in traditional asset markets.