Note: These assumptions are now outdated. Our current capital market assumptions and our white paper documenting their construction can always be found on our Capital Market Assumptions page.

Sellwood Consulting’s 2019 Capital Market Assumptions are available. These 10-year, forward-looking assumptions of asset class return, risk, and correlation are the key input variables for our asset allocation work on behalf of clients.

Our Assumptions Change as Markets Do

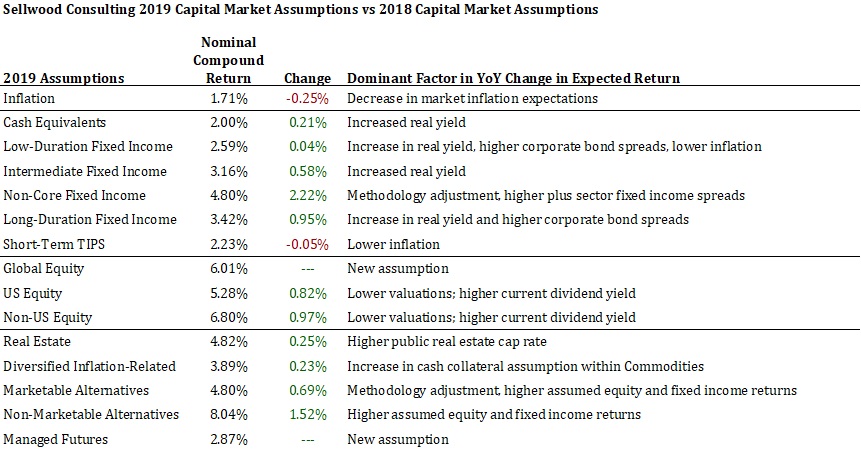

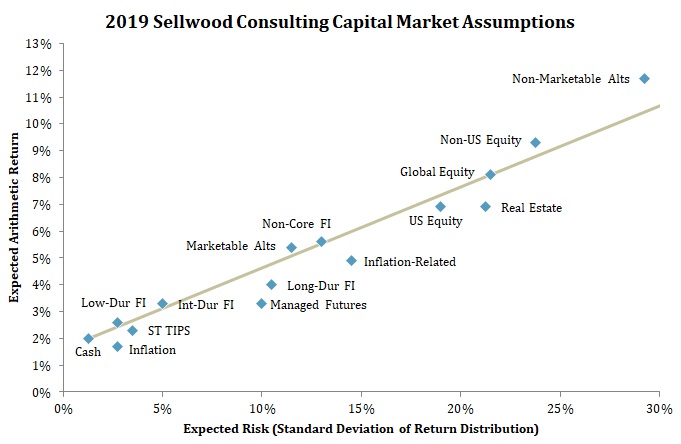

We update our assumptions annually. Over the course of 2018, most bond yields rose and equity market valuations declined. For this reason, our 2019 assumptions forecast higher returns for almost every asset class.

As a result of these updates, our forecasted “capital markets line,” depicting opportunities for investment return at varying levels of risk, has steepened: we believe that over the next ten years, investors will receive more compensation for taking risk than they were poised to a year ago. In the case of fixed income, higher real yields bring greater opportunity for return with lower risk. For risky assets, like global equities, the market experience of 2018 brought lower valuations, which increase the potential for future return.

Methodology Changes

While most changes to the assumptions simply reflect new market inputs, we made a few changes to our methodology this year.

First, we have slimmed down the assumption set, to include a more compact set of assumptions. The new assumptions are now mostly non-overlapping and for the largest segments of the global capital markets. For example, whereas in the past we have published assumptions for (all-cap) US Equity, Large-Cap US Equity, and Small-Cap US Equity, we now publish only an all-cap US Equity assumption. Asset allocation analysis is a blunt tool, and we believe that input assumptions should not be more granular than the methodology can support. Using a more limited set of assumptions reduces the risk of false precision when implementing them.

Additionally, we have updated our methodology for Non-Core Fixed Income, specifically our forecast for default rates for emerging markets bonds. In the past, we assumed that historic default rates would persist into the future. We have observed, however, that default rates have been much lower, after adjusting for ratings quality of the issuer, in the recent past. We now average default rates for the last decade and the longest period of data available, which assumes lower default rates, increasing the expected return.

We have also created new assumptions for Global Equity and Managed Futures.

Modeling Risk in 2019

The beginning of 2019 is an interesting time to model risk. On one hand, following one of the longest bull markets in history, it would seem that market risk would be higher, not lower, than in the recent past. Higher prices represent higher risk, all else equal.

On the other hand, any model that calculates risk looking back ten years will, for the first time in a decade, not include the experience of 2008.

Our approach to modeling risk has never changed. It has always looked back ten years, and longer, but we have never simply assumed that historical risk will repeat in the future. Instead, our approach forces years like 2008 to be acknowledged. For that reason, the “qualitative adjustments” to risk in our process are much higher in our 2019 assumptions than they have been in the past. For more detail, please see pages 27-30 of our white paper.