There are too many investment managers in the world, and one of our primary tasks is identifying the very slim minority of them that deserve to manage our clients’ assets.

In 1991, William Sharpe published The Arithmetic of Active Management, in which he persuasively concluded, because all markets are a zero-sum game between buyers and sellers, that “properly measured, the average actively managed dollar must underperform the average passively managed dollar, net of costs. Empirical analyses that appear to refute this principle are guilty of improper measurement.”

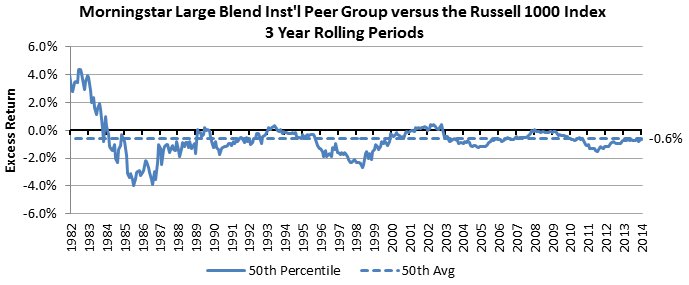

Several rigorous empirical studies have, in fact, not refuted this principle. Studies have repeatedly shown that the majority of active managers underperform – subtract value – after their fees. A recent Vanguard study, for example, showed that 72% of US large cap value equity funds underperformed in the ten-year period ending December 2014. Other asset classes exhibited similar results, even in so-called “less-efficient” market spaces, such as small cap and emerging markets equity. Using similar data, but considering only “institutional” share classes of funds (which gives active managers the benefit of the doubt by considering only their lowest-fee share classes), we have found that the median US large-cap blend manager has not added value in about 30 years.

Still, we do believe that talented active managers have a role to play in most client portfolios. Identifying them requires a combination of qualitative and quantitative insights, and the soft skills of experience and judgment. We do not believe that a computer can identify active managers worth hiring.

Success With Active Management is More Complex Than Most Think

Philosophically, we believe that “markets are reasonably efficient, and that active management should be pursued only where it is likely to be rewarded. Active management is always a source of risk, and only sometimes a source of excess return.”

While our focus here is on our methods for identifying superior active managers, we are mindful that successfully identifying an outperforming manager – itself a very tall order – is only one part of the broader picture of “success in investing with active management.” Success with active management depends on the successful alignment of several factors:

- Identifying a superior investment manager.

- Identifying the “right” superior investment manager. Picking a good investment manager that is either an improper fit for the portfolio or that has a risk profile that causes client heartburn is, in the long run, more likely to subtract value than add it. A good strategy that a client can stick with is better than a perfect strategy the client can’t stick with.

- Giving the active manager enough time after the hire to prove whether the manager’s relative performance is the result of skill, rather than luck. This period of time varies for each manager, and it takes skill and judgment to assess it. Managers with higher tracking error relative to their benchmarks generally require a longer evaluation period.

- Firing the manager at the right time. There are many reasons to terminate a manager – organizational instability, style drift, major changes in assets under management, etc.

- Not firing the manager at the wrong time, only to replace the manager with another active manager whose performance pattern is different. This sets the portfolio up for a “whipsaw” effect whereby a terminated manager is replaced with one more likely to underperform after the hire.

The stars must truly align for active management to be executed with success. Violating even one of these factors can undermine the entire case for active management itself. Our experience causes us to view active management in its appropriate complexity – and with appropriate humility. Successful alignment of all of these factors is a difficult task.

So why pursue active management at all? The short answer is: we often don’t. We believe that any client’s “default” investment position, after making the asset allocation decision to invest in an asset class, is a low-cost passive investment that offers reliable beta exposure to the asset class. We believe that the “burden of proof,” so to speak, to justify inclusion in a client portfolio rests with any active manager. A lower-cost alternative is always available, and it only makes sense to pay a higher cost if this burden is met, persuasively.

Why Play This Game at All?

There are several reasons, in our view, to take measured risk by hiring active managers.

First, we believe that indexes (and the index funds that track them) are wonderful, but they aren’t perfect. The S&P 500 index, for example, is simply a collection of 500 stocks, organized in the index according to their overall size (market capitalization). What process determines this list of 500 stocks? Just a committee of people, with a mandate to create an index that is “a leading indicator of U.S. equities, reflecting the risk and return characteristics of the broader large-cap universe on an ongoing basis.” While the committee follows guidelines to select stocks that are included in the index, it is not a rules-based approach. It occurs to us that it is at least possible that a different committee of people (say, at an active management organization) could construct a better list of securities (a portfolio) with a mandate to produce superior return (rather than the academic exercise of representing a market). We love indexes – and we love index funds, which wouldn’t exist without benchmarks like the S&P 500. But benchmarks are not designed to produce superior return; they are designed to represent markets.

Second, when we say in our Investment Philosophy that “active management is always a source of risk,” we mean it in the stars-aligning sense described above. We believe, and data supports, that there are active managers whose inclusion in portfolios makes those portfolios reliably less risky, in several dimensions.

Common-Sense Manager Selection

Knowing the risks and pitfalls of active management itself, let us turn to how we believe that we tilt the odds in our clients’ favor when selecting or recommending active managers.

All else equal, we prefer to see the following traits in active managers that we consider for client portfolios:

- Stable and consistent teams/organizations. Without organizational stability, we cannot have confidence that an attractive process or result can be repeated.

- Articulated value proposition. A manager must have the ability to express a coherent rationale for the strategy to consistently outperform its benchmark, and explain in what sorts of markets the strategy should be expected to outperform or underperform. If it is true that markets are a zero-sum game, for any manager to outperform, another investor must underperform. We like active managers to identify who that underperformer is.

- Assets under management. We monitor the growth of assets under management closely and prefer that our clients invest with investors, not asset aggregators. We are mindful that manager incentives can change, adversely to the client, as assets grow.

- Low fees. Fees raise the hurdle a manager’s skill must overcome to deliver superior performance. We insist that our clients pay the lowest possible fees for a given strategy, and wherever possible negotiate lower fees on behalf of our clients. We also evaluate and present to our clients only net-of-fees manager returns. The manager’s return before deducting the manager’s fee is irrelevant.

- High active share, for equity managers. We believe that managers must be truly active to earn active-management fees. This becomes more important as the gap between an active manager’s fee and the index option’s fee increases.

- Lower volatility and demonstrated downside protection. We believe that investing in strategies that are less volatile than the market, especially on the downside, increases the rate at which the investment compounds and provides for superior returns over time.

- Reasonable tracking error. While we do not believe that levels of tracking error determine success of a given strategy, we do believe that reasonable tracking error makes it easier to stay invested with a manager during inevitable periods of underperformance, and it gives us a higher degree of confidence that a manager’s superior performance pattern is due to skill rather than luck.

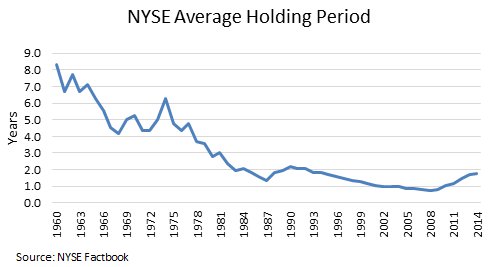

- Low turnover. We believe that longer holding period strategies properly align managers to our clients’ investment horizons, decrease trading costs, and provide opportunity for outperformance, given the increasingly short-term nature of the markets. Studies show that today, the average holding period for a US stock is just 2 years (down from 8 years in 1960).

Importantly, we view these factors as elements of successful investment strategies, not items on a checklist. While we examine these factors quantitatively, where possible, we do not “screen out” managers based on not meeting an arbitrary hurdle for each of them. This process forces us to rely on our judgment and expertise more than on quantitative screens to identify managers, but we strongly believe that it is the optimal way – perhaps the only way – to identify future outperformers.

Finally, we believe that none of this is possible without conversation with the manager. We insist on speaking with every manager that we recommend or select on behalf of a client.

How Not to Pick Managers, and the Luck/Skill Conundrum

A close inspection of the list above will reveal one common element that is missing: an evaluation of the level of past returns. While historical performance consistency and risk-adjusted return metrics can yield valuable insights, a simple review of the level of past returns does not. “Past performance is no guarantee of future performance” is not merely a disclaimer. It has been proven true, time and time again. In fact, there is evidence to suggest that past performance is an indicator of future performance – only in the opposite direction. Past outperformers tend to be future underperformers, and vice-versa.

Moreover, all investment results are the result of a combination of luck and skill. We do not believe it is worth paying active management fees for luck – but any analysis of past returns will inevitably introduce the risk of doing so.

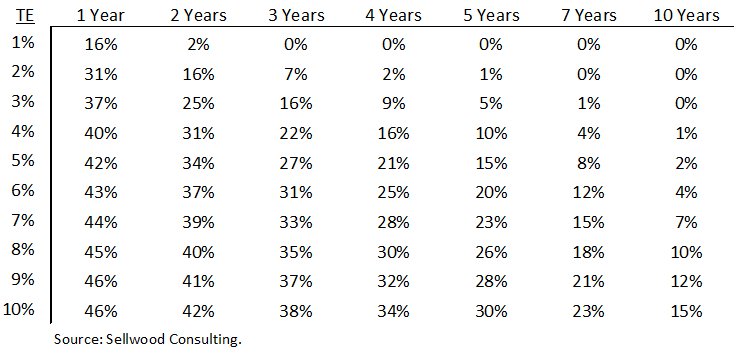

We designed a simple thought experiment using nothing more than basic probability mathematics to answer the question: what are the odds of a good manager looking like a bad manager, or a bad manager looking like a good manager, simply due to luck? In this thought experiment, we first assume ten hypothetical managers, each of which expects to earn a long-run return of 1% annualized more than their benchmark — in other words, we assume that each manager is talented. Each manager is identical except for their level of tracking error, or return variability around the benchmark. In our experiment, each manager has a tracking error of returns between 1% per year and 10% per year.

Our thought experiment reveals that as tracking error increases, the odds of a talented manager underperforming increase with it. Higher levels of tracking error widen the manager’s distribution of excess returns, and the number of possible negative excess return outcomes rises as those distributions widen further into negative territory. The following chart depicts the probabilities of each hypothetical, talented, active investment manager underperforming the benchmark simply due to bad luck, over various time periods:

Probabilities of Underperforming the Benchmark over Various Horizons,

for a Manager that Earns 1% Annualized Excess Returns Over Time,

at Various Levels of Tracking Error

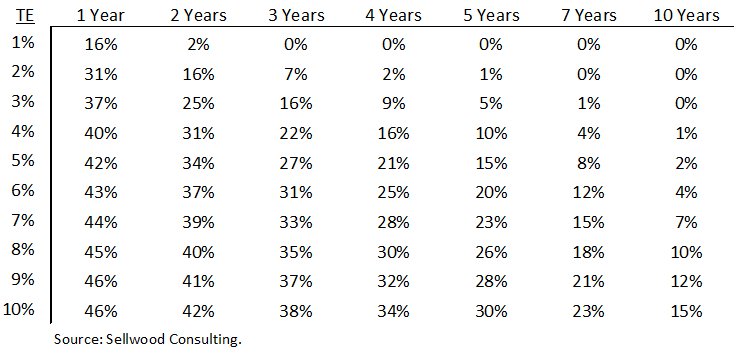

Conversely, the math is identical if we assume the opposite case: the case of a manager that is not talented experiencing a positive excess return over various time periods, due to good luck, at various levels of tracking error. The percentages in the table above are the same if we assume a manager whose “true” long-term level of outperformance is negative 1% annualized, and we consider the probabilities of seeing positive excess return over various time periods:

Probabilities of Outperforming the Benchmark over Various Horizons,

for a Manager that Earns -1% Annualized Excess Returns Over Time,

at Various Levels of Tracking Error

The more a manager’s return pattern differs from the benchmark – expressed here as demonstrating a higher tracking error – the longer the manager must be evaluated or monitored to assess whether their return pattern is due to skill or luck. But at higher levels of tracking error, the influence of luck never goes away. Wider distributions of excess return increase the odds of making a poor manager selection or termination decision. This is one reason that we prefer managers, all else equal, to express lower levels of tracking error. It is the mathematical reason why we believe that the whole endeavor of active manager selection should be approached with humility. It is also the reason why we tend to recommend managers that clients can stick with for a long time – and why we then recommend that clients have slow trigger fingers in the inevitable event of underperformance, if the underperformance is not accompanied by changes in the more qualitative factors listed above.

Conclusions

Successful investing with active managers is very hard, and it’s not made easier by the fact that most active managers are worth neither the fees they charge nor the consideration of serious investors. A low-cost, passive index fund is in our view the “default” investment choice to implement any asset class for which an index fund option exists. The burden of proof should fall on active managers to justify their inclusion in client portfolios instead of an index fund. Past performance alone does not meet that heavy burden, because past performance always combines skill and luck – only one of which is worth paying for.

We believe that there are managers that meet that burden, but neither a computer nor an inexperienced analyst will find them. While we look at hundreds of numbers analyzing any investment manager’s strategy or product that we research, it is experience and judgment that matter most. The world is awash in numbers; we have thousands of them available at our fingertips. It is only with judgment forged by experience that we can sift through the noise and identify what matters in manager evaluation.

In the end, we are trying to find needles in haystacks – but carrying magnets.

Further Reading

- The Arithmetic of Active Management, William Sharpe (1991).

- The Case for Index-Fund Investing, Vanguard (2015).

- Does Past Performance Matter? The Persistence Scorecard, S&P Dow Jones (2015).

- Is There a Case for Actively Managed Funds?, Wall Street Journal (2015).

- Winning the Loser’s Game, Charlie Ellis (1998).

- The Success Equation: Untangling Skill and Luck in Business, Sports, and Investing, Michael Mauboussin (2012).