Rebalancing is a critically important element of portfolio management, but it gets scarcely the attention it deserves. Our research shows that disciplined rebalancing is necessary to maintain a portfolio at its desired risk and return levels – without it, the whims of the market can considerably alter a portfolio’s composition. Many methods of rebalancing have been suggested. We attempt to sift through these varied approaches to determine which policy might be optimal. Along the way, we find that most of the industry’s research to identify an optimal rebalancing method is misguided, asking and answering the wrong question.

We conclude that rebalancing is essential; that the appropriate way to evaluate a rebalancing approach is how it changes a portfolio’s risk, not return, characteristics; and that the results of most rebalancing approaches are surprisingly similar. We find that the most important decision is simply to have a rebalancing strategy – after that, we recommend the method that introduces the fewest costs of implementation. As with many ideas in investing, increased complexity does not necessarily translate to portfolio benefit.

Why Rebalance?

Rebalancing is a systematic process of buying and selling a portfolio’s assets as they drift away from their intended target allocations in order to return them to, or toward, those target allocations.

Rebalancing is necessary with a diversified portfolio, because the portfolio’s assets can move in different directions or with different magnitudes, causing their proportion in the portfolio to change as markets move.

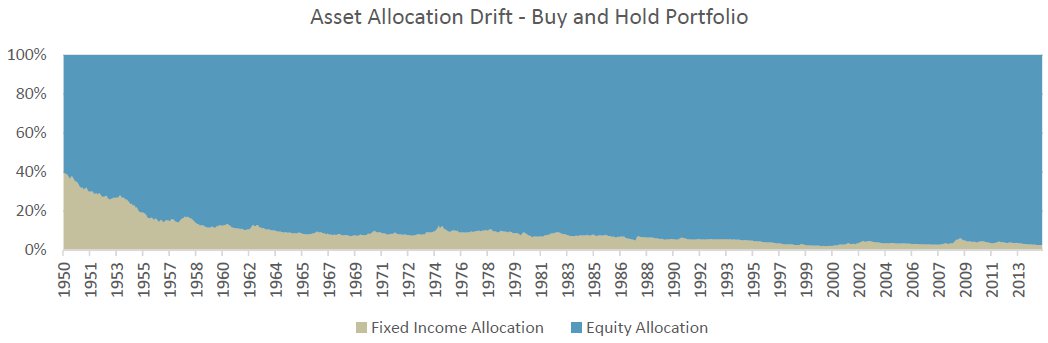

The following chart depicts a simple portfolio that began in 1950 with a target allocation of 60% stocks and 40% bonds, and was never rebalanced. Because the stocks outperformed the bonds, over time they assumed an ever-greater weighting in the portfolio. By the end of 2013, stocks made up 97% of the portfolio, and bonds only 3%. For an investor who desired a 60/40 allocation, the lack of rebalancing resulted in a very different, and substantially riskier, portfolio.

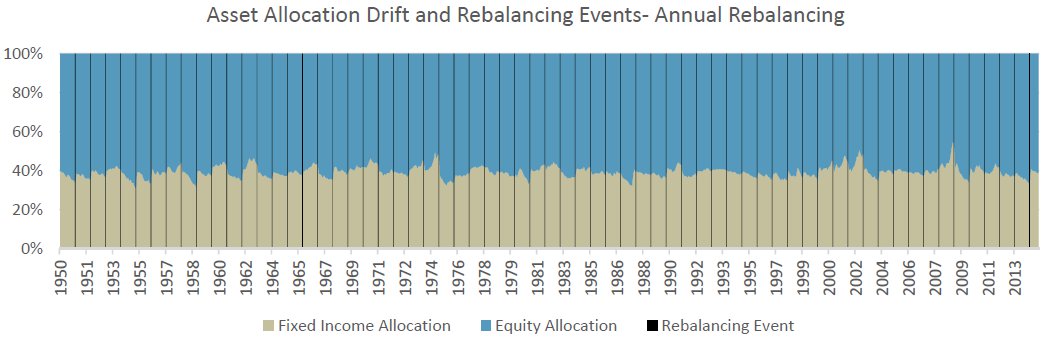

Substantial portfolio drift can be corrected by even the simplest rebalancing mechanism. The following chart depicts the asset allocation mix over time for the same portfolio, this time with a rebalancing rule whereby the portfolio is simply brought back to its target asset allocation once per calendar year.

This simple approach does pretty well at keeping the equity/bond allocation consistent with the original objective: under this rebalancing policy, the targeted 60% equity allocation never exceeded 67%, and the fixed income allocation never dropped below 33%.

But this is just one approach to rebalancing. Several methods exist:

- The periodic approach (or “calendar” approach), which rebalances a portfolio back to its targets on a regular basis (typically monthly, quarterly, or annually), regardless of the magnitude of the rebalancing required.

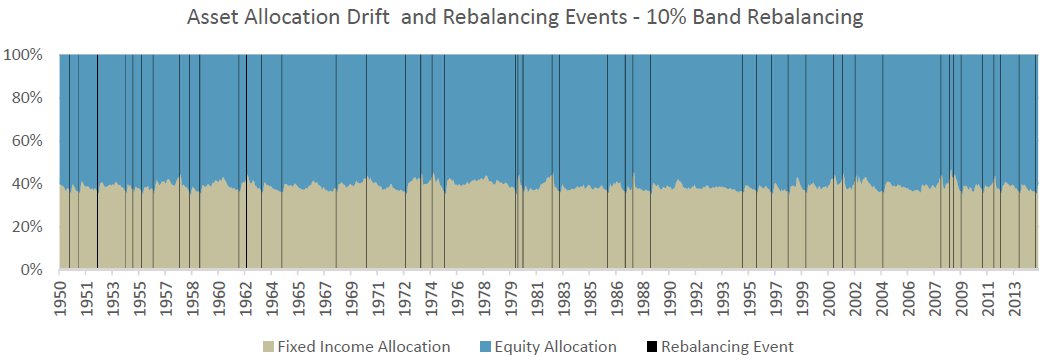

- The “range band” approach, where tolerance ranges are established around each asset class’s target allocation and rebalancing is triggered when those ranges are breached. For example, a 10% range would imply that a 60% targeted equity allocation is rebalanced back to target if the equity allocation grows above 66% of the portfolio or falls below 54% of the portfolio.

- The “volatility band” approach is similar to the range band approach, but with ranges determined not by targeted allocation but by the volatility of the assets being rebalanced. Under this approach, more-volatile assets are given wider ranges to roam.

- More complex approaches that determine range bands based on combinations of asset target weights and asset volatility.

For each of these approaches, various permutations exist that change the frequency of triggered rebalancing, and consequently they differ in their allowance for the portfolio to drift away from its target.

Which Rebalancing Method is Best?

We have reviewed much of the industry’s research on optimal rebalancing methods; most research focuses on the return benefits of rebalancing (or, of not rebalancing). We believe that focusing on potential return benefits of rebalancing misses the point. Fundamentally, rebalancing is a risk management tool, not a return enhancement tool. It will likely always be the case that higher returns can be earned by not rebalancing, or by rebalancing less frequently, simply because equities expect higher returns than most other portfolio assets over the long term. But this higher return comes at the cost of higher portfolio risk. Portfolios that do not rebalance, or do so very infrequently, have the potential for higher returns because the fundamental characteristics of these portfolios tend to change – namely becoming more equity-like over time.

Recognizing that the primary purpose of rebalancing is to maintain a portfolio’s risk at its intended level, we compare various rebalancing methods using various risk characteristics, most notably:

- Tracking error of the rebalanced portfolio relative to its monthly-rebalanced target

- Maximum drawdown of a rebalanced portfolio

- Standard deviation of returns of a rebalanced portfolio

In practical terms, we also examined how frequently each rebalancing method would trigger a rebalancing event. Our research focused on the broad question of how much portfolio benefit (in the form of risk reduction) each rebalancing method achieved, relative to the cost, in time and dollars, required to implement it (measured by the count of rebalancing events per decade).

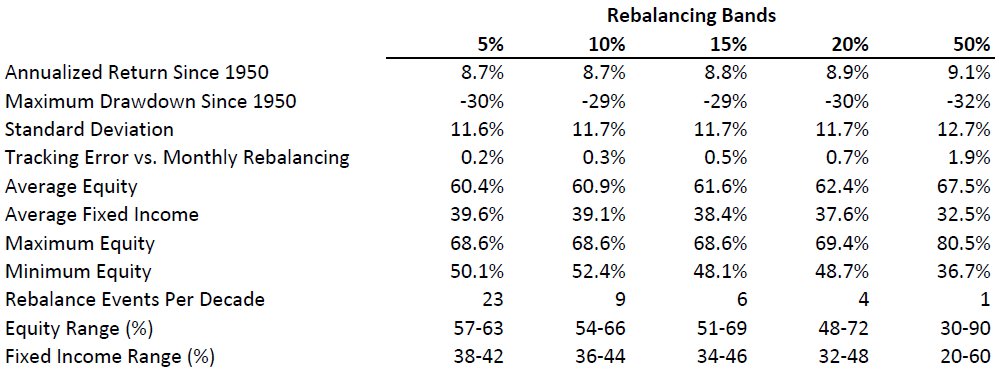

The results of our analysis are illustrated below. This table quantifies the portfolio effects of various rebalancing methods, all applied to the same portfolio that began in 1950, allocated 60% to stocks and 40% to bonds:

First, the Buy and Hold portfolio (the one that never experiences rebalancing) expects the highest return. This is consistent with our expectations, given its meaningfully higher exposure to equities over the course of the evaluation period. If all our hypothetical investor cared about was return, though, he would have been better off simply investing 97% of his portfolio in equities from the beginning rather than being pushed there haphazardly by market movements. Additionally, this portfolio exhibits meaningfully inferior risk characteristics relative to any of the rebalanced portfolios, whatever their method. We conclude from this fact that it is better to rebalance than not to rebalance.

Second, once the decision has been made to rebalance, we note how strikingly similar the results of the various approaches are to one another. From the simplest “rebalance once a year, according to the calendar” method to the most complex adjusted-standard-deviation-bands method, the rebalanced portfolios are comparable across each characteristic we evaluated. We conclude from this that the method of rebalancing is not as important as the initial decision to rebalance.

Third, we note that notwithstanding their similar results, there does exist some meaningful variation in the frequency of rebalancing events across the different approaches. Method #4, which employs a complex system to determine the size of allocation bands, triggers a rebalancing event approximately 3-4 times as often as the other methods. Rebalancing this frequently can incur real portfolio costs, as well as the time and attention of asset fiduciaries. This is the approach with the lowest tracking error to target, but that tracking error is only modestly lower than other approaches, for three times the effort (and potentially, cost). Without a meaningful portfolio benefit associated with this complexity, we conclude that we prefer simpler rebalancing approaches to more complex approaches.

Fourth and finally, among the remaining approaches, we conclude that a method of setting rebalancing bands based on portfolio allocation (Method #3) likely makes the most sense for most investors. This approach generates the second-lowest tracking error of portfolio returns relative to target of all the approaches, compares at least equally to the other approaches in terms of standard deviation, and results in a triggered rebalancing event approximately once per year. This approach also has the advantage of being responsive to changing market volatility regimes. As compared to calendar-based rebalancing, roughly the same number of rebalancing events are concentrated more in volatile market times, meaning that the rebalancing tool is deployed when it can be most effective.

To this point, our research compared various percentage-of-target range bands according to the same criteria outlined above and concluded that 10% range bands strike the most ideal balance between efficacy and cost. For example, widening the ranges from ±5% to ±10% only increased tracking error from 0.2% to 0.3%, but it resulted in nearly four times as many rebalancing events per decade.

To summarize our research conclusions:

- An unrebalanced portfolio will, over time, become increasingly allocated to its highest-returning asset, which is usually its riskiest asset. Unrebalanced portfolios grow riskier over time.

- For an investor who cares about risk, it is always better to rebalance than not to rebalance.

- The chosen method of rebalancing is not as important as the decision to rebalance.

- Complex rebalancing approaches do not appear to offer meaningful advantages over simpler approaches. We prefer simpler rebalancing approaches.

- For most investors, a rebalancing approach based on percent-of-target ranges makes the most sense.

- For most investors, using a 10% range band appropriately balances the benefits and costs of rebalancing.

Other Practical Considerations

Most portfolios are not stagnant and experience cash inflows and outflows on a regular basis. These cash flows are perfect opportunities to rebalance the portfolio, and we recommend that clients, when possible, use portfolio cash flows to bring their portfolios into balance. Doing so brings a portfolio closer to its targets on an ongoing basis and reduces both tracking error relative to its target allocation and the frequency of a more comprehensive and potentially costly rebalancing event being triggered.

In addition, most mechanistic rebalancing policies presume that portfolios are 100% allocated to liquid investments that can be purchased and sold on a daily basis. To the extent that a portfolio contains less-liquid investments, we recommend that clients employ a qualitative approach that sets wider bands, to trigger rebalancing less frequently for those less-liquid assets.

Conclusions

Rebalancing might be the hardest easy thing to do to improve portfolio results. By its very nature, rebalancing is supposed to happen when it is least comfortable to let it happen – e.g., buying more stocks just after they have fallen. Investors have well-documented behavioral biases against rebalancing.

We recommend that clients consider and determine a mechanized rebalancing policy before market volatility forces the question of whether it makes sense to rebalance. Thinking of rebalancing as a system rather than a decision improves outcomes, and doing so might allow portfolios to take advantage of other investors’ behavioral biases rather than becoming subject to them.

Our research evaluated various rebalancing approaches from the perspective of how they affect portfolio risk, because rebalancing is fundamentally a risk mitigation exercise. We found that rebalancing is critically important, but that the method of rebalancing is less important than the decision to rebalance. For most clients, using a range-based approach where the ranges are based on portfolio target asset allocation effectively balances the benefits and costs of rebalancing. To the extent feasible, we also recommend that clients use cash flows to rebalance their portfolios on an ongoing basis. Illiquid investments do not change the need to rebalance, but they must be considered qualitatively when developing a rebalancing policy.