First Quarter 2023: Resilient Economy, Weak Banks, Swift Intervention

Softening inflation, a budding banking crisis, and a strong overall economic picture caused investors to re-evaluate their expectations for future interest rates in the first quarter. As a result, many of 2022’s trends – of lower asset prices in general, investor preferences for value stocks over growth stocks, and the dominance of energy-related assets – reversed themselves.

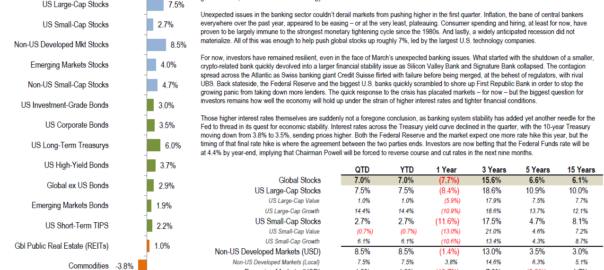

Unexpected issues in the banking sector couldn’t derail markets from pushing higher in the first quarter. Inflation, the bane of central bankers everywhere over the past year, appeared to be easing – or at the very least, plateauing. Consumer spending and hiring, at least for now, have proven to be largely immune to the strongest monetary tightening cycle since the 1980s. And lastly, a widely anticipated recession did not materialize. All of this was enough to help push global stocks up roughly 7%, led by the largest U.S. technology companies.

For now, investors have remained resilient, even in the face of March’s unexpected banking issues. What started with the shutdown of a smaller, crypto-related bank quickly devolved into a larger financial stability issue as Silicon Valley Bank and Signature Bank collapsed. The contagion spread across the Atlantic as Swiss banking giant Credit Suisse flirted with failure before being merged, at the behest of regulators, with rival UBS. Back stateside, the Federal Reserve and the biggest U.S. banks quickly scrambled to shore up First Republic Bank in order to stop the growing panic from taking down more lenders. The quick response to the crisis has placated markets – for now – but the biggest question for investors remains how well the economy will hold up under the strain of higher interest rates and tighter financial conditions.

Those higher interest rates themselves are suddenly not a foregone conclusion, as banking system stability has added yet another needle for the Fed to thread in its quest for economic stability. Interest rates across the Treasury yield curve declined in the quarter, with the 10-year Treasury moving down from 3.8% to 3.5%, sending prices higher. Both the Federal Reserve and the market expect one more rate hike this year, but the timing of that final rate hike is where the agreement between the two parties ends. Investors are now betting that the Federal Funds rate will be at 4.4% by year-end, implying that Chairman Powell will be forced to reverse course and cut rates in the next nine months.