Fourth Quarter 2022: What’s Next?

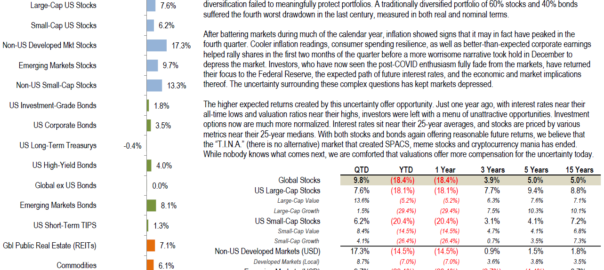

A tepid fourth-quarter rally in both stocks and bonds helped cut losses to close out a frustrating year for investors. For the full year, both global stock and investment-grade bond market indices suffered double-digit losses, as stock/bond diversification failed to meaningfully protect portfolios. A traditionally diversified portfolio of 60% stocks and 40% bonds suffered the fourth worst drawdown in the last century, measured in both real and nominal terms.

After battering markets during much of the calendar year, inflation showed signs that it may in fact have peaked in the fourth quarter. Cooler inflation readings, consumer spending resilience, as well as better-than-expected corporate earnings helped rally shares in the first two months of the quarter before a more worrisome narrative took hold in December to depress the market. Investors, who have now seen the post-COVID enthusiasm fully fade from the markets, have returned their focus to the Federal Reserve, the expected path of future interest rates, and the economic and market implications thereof. The uncertainty surrounding these complex questions has kept markets depressed.

The higher expected returns created by this uncertainty offer opportunity. Just one year ago, with interest rates near their all-time lows and valuation ratios near their highs, investors were left with a menu of unattractive opportunities. Investment options now are much more normalized. Interest rates sit near their 25-year averages, and stocks are priced by various metrics near their 25-year medians. With both stocks and bonds again offering reasonable future returns, we believe that the “T.I.N.A.” (there is no alternative) market that helped create SPAC, meme stock, and cryptocurrency mania has ended. While nobody knows what comes next, we are comforted that valuations offer more compensation for the uncertainty today.